- Key Point 1

- Key Point 2

- Key Point 3

Animoca Brands recently enhanced its AERO holdings, forming veAERO to back AerodromeFi, a prominent platform on Base Chain commanding over 50% of the DEX’s total value locked.

This underscores Animoca’s dedication to sustainable token economics, bolstering its position by optimizing liquidity management, incentivizing rewards, and ensuring robust governance via voter-driven liquidity allocations.

Animoca Boosts AERO Holdings for DeFi Liquidity on Base Chain

Animoca Brands has taken a significant step in the cryptocurrency market by establishing and maximizing its AERO holdings as veAERO, aimed at supporting AerodromeFi on the Base Chain. The news was reported by PANews on October 28, 2025.

The investment underscores Animoca’s strategic efforts to enhance liquidity and governance within the DeFi ecosystem, particularly on the Base Chain.

“The investment represents Animoca’s unwavering commitment to expanding DeFi infrastructure through tactical innovations,” said Yat Siu, Executive Chairman of Animoca Brands.

Market Shifts as Animoca Bets on veAERO for Governance

Did you know? Venture-led liquidity injections using ve-token mechanisms, like Animoca’s with AerodromeFi, often lead to increased protocol resilience, similar to past events seen with Curve Finance’s governance wars.

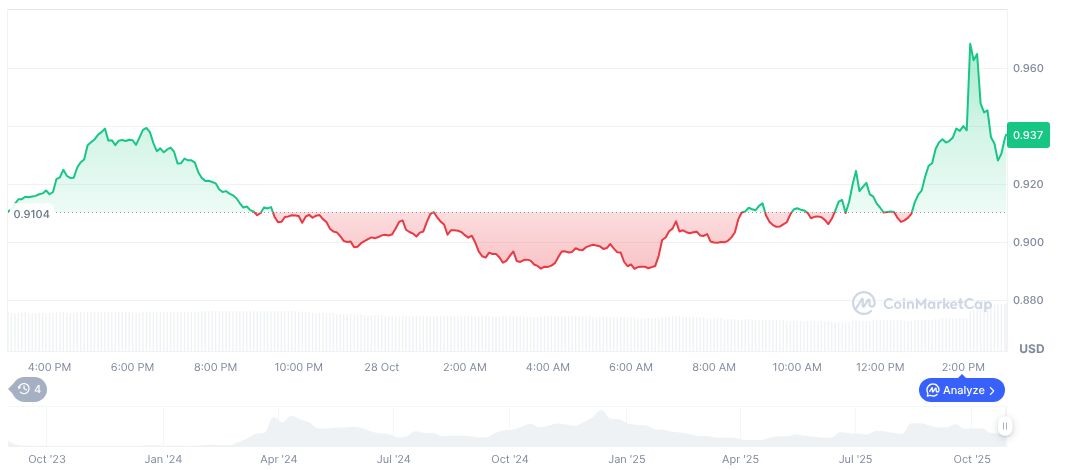

Aerodrome Finance (AERO) currently trades at $0.93, with a market cap of $841.25 million and a 20.80% increase in trading volume over the last 24 hours, as noted by CoinMarketCap. Over the past 90 days, AERO has seen a 14.46% increase, though it remains down by 18.68% over the past 60 days. Despite fluctuations, AerodromeFi sustains its market viability.

Expert insights indicate that Animoca’s approach could influence regulatory perceptions in crypto markets, potentially fostering a more supportive regulatory environment for ve-token models. Historical analysis suggests such investments boost liquidity resilience and on-chain stability, a trend observed in other outsize DeFi ecosystems.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |