In Brief

- Binance funding rates remain positive, suggesting short-term bullish momentum is building.

- Bitcoin trades near $114K as ETF inflows signal renewed institutional interest and support.

- TD Sequential indicator flashes a sell signal, raising short-term correction concerns.

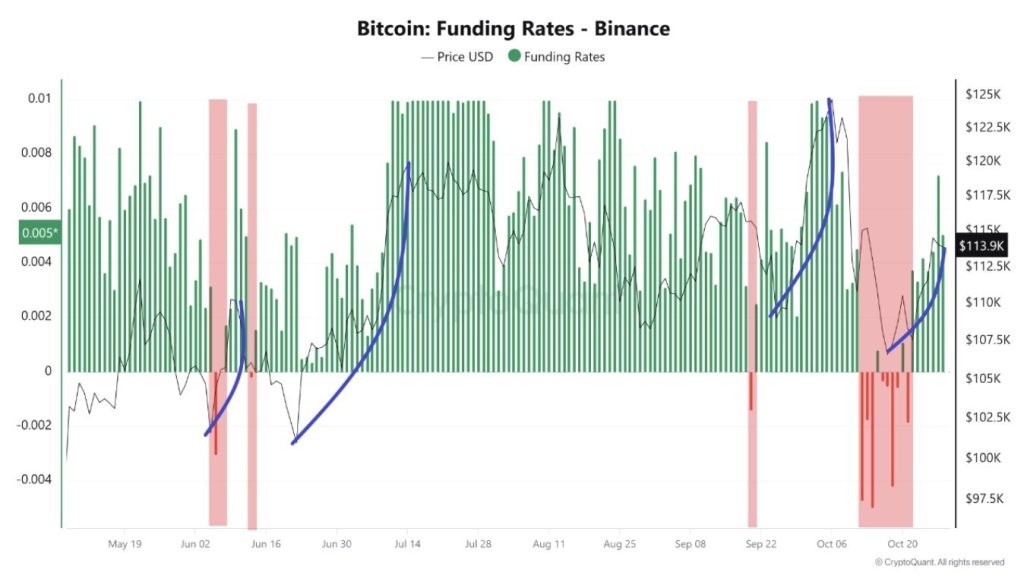

Bitcoin’s Binance funding rates have remained positive since October 22, signaling improved confidence across both spot and derivatives markets. Historically, this metric acts as a short-term trend indicator, often aligning with bullish reversals after local price bottoms.

As of today, Bitcoin is trading around $114,300, maintaining strength above the $113,000 level despite recent price consolidation.

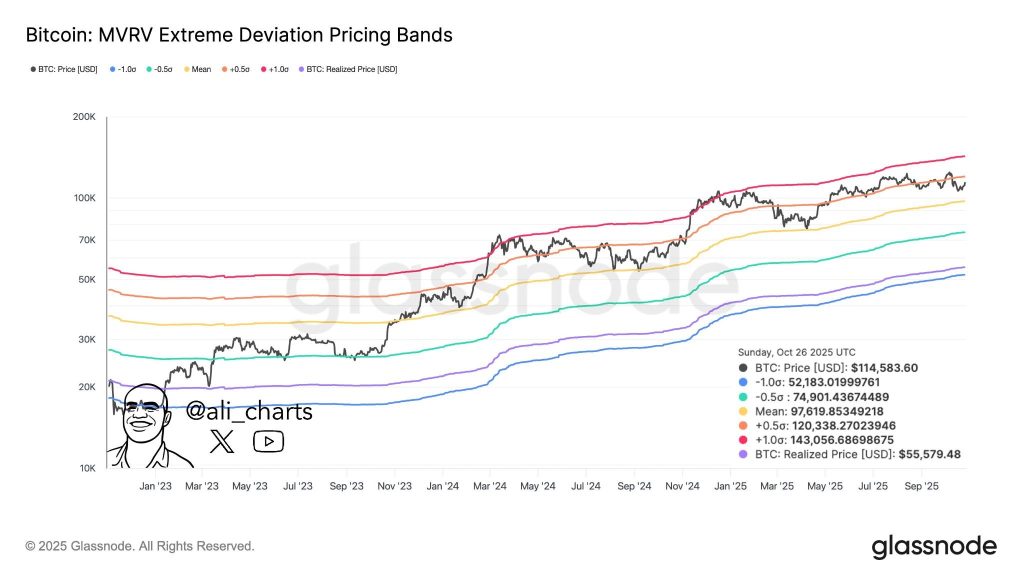

According to Glassnode’s MVRV Extreme Deviation Pricing Bands, BTC sits just below the +0.5σ level at $120,338, while the mean price holds near $97,619 and the realized price stands at $55,579. These levels offer robust on-chain support and suggest potential upside if momentum builds.

A confirmed breakout above the +0.5σ band could open a path toward the +1.0σ pricing zone at $143,056. This target marks a potential run toward a new all-time high, especially if strong buying volume persists in the coming days.

On-chain data shows that structural strength has improved, aligning sentiment and metrics more clearly in a bullish direction.

ETF Inflows and Technical Risks Present a Mixed Outlook

Meanwhile, spot ETFs continue to support market sentiment. On October 28, Bitcoin ETFs registered a net inflow of $202 million, marking a third consecutive day of gains. Ethereum ETFs recorded even stronger activity, with $246 million in inflows, led by Fidelity’s FETH adding $99.27 million.

Despite these signals, caution remains. Analyst data shows the TD Sequential indicator has issued another sell signal for Bitcoin. In 2025, this same indicator has preceded sharp corrections of 7%, 13%, and 19%.

Bitcoin’s mid-phase bull structure remains intact, but technical resistance and trader positioning will determine short-term moves. A sustained break above $120,000 may validate the rally narrative, while failure to hold current levels could invite short-term selling. The next few sessions will be key in confirming direction.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |