In Brief

- SEI holds key $0.19 support; wedge breakout could target $0.70–$0.80 in strong rally.

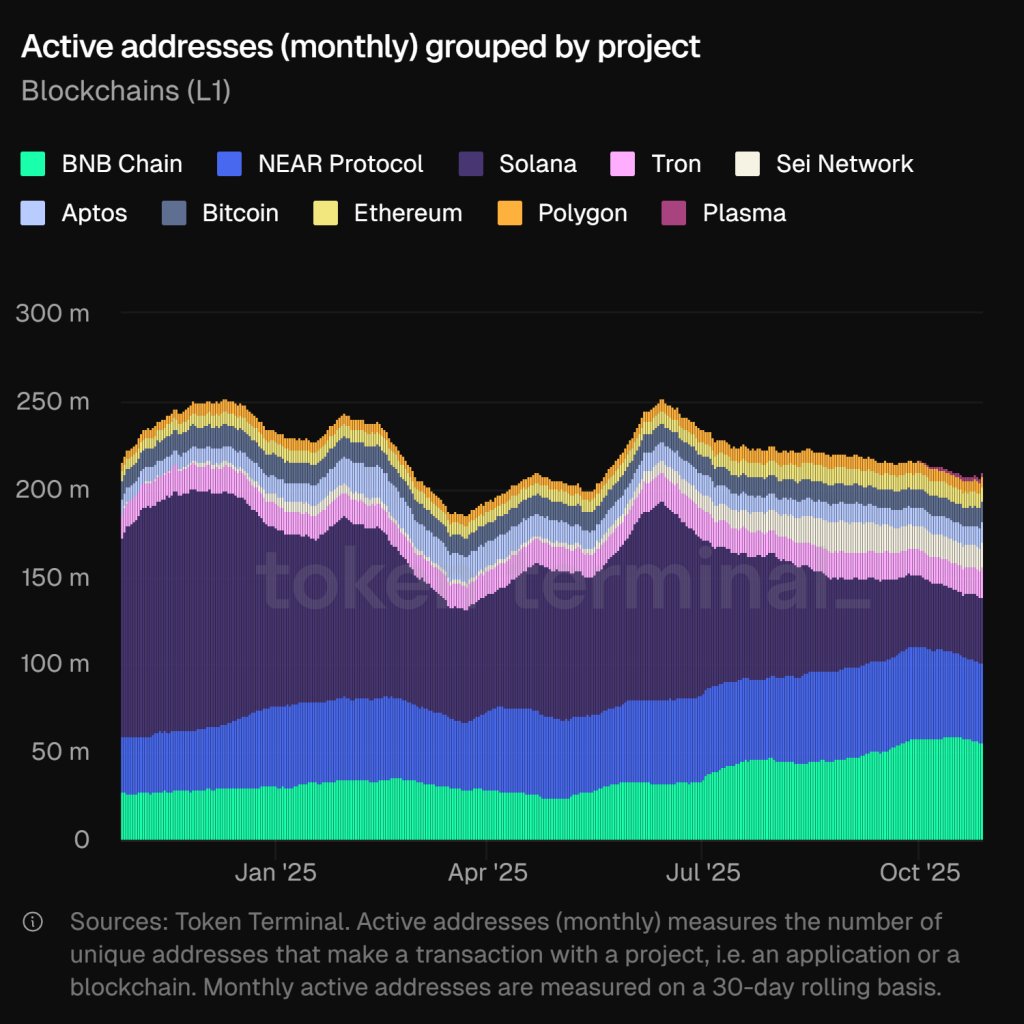

- SEI now ranks 5th in active Layer-1 addresses, showing rising adoption and traction.

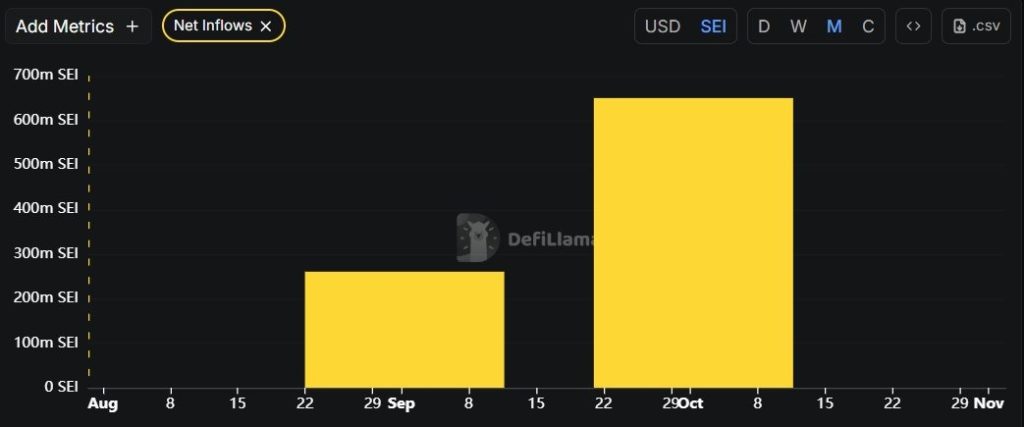

- October net inflows surge over 2x, supporting SEI’s growing DeFi and RWA ecosystem.

SEI is holding steady near the $0.19 support zone, a level closely watched by analysts as a possible springboard for a bullish move. Technical patterns suggest that maintaining this base could lead to a surge toward $0.31–$0.44, aligning with the upper trend channel.

Analyst Mister Crypto notes SEI is nearing a breakout from a long-term descending wedge, which often precedes major rallies. If price breaks the upper trendline, SEI may quickly climb toward the $0.70–$0.80 range due to compressed volatility and momentum buildup.

Michaël van de Poppe also remains bullish, pointing out that SEI has returned to higher timeframe support after clearing resistance liquidity. He expects a potential 100–200% move against BTC, citing strong fundamentals and improving technical structure.

Network Activity and Capital Inflows Strengthen the Bullish Case

Beyond technicals, on-chain data shows SEI’s ecosystem continues to gain traction among retail and institutional users. According to Token Terminal, Sei Network now ranks 5th among top Layer-1 chains by monthly active addresses, trailing only BNB Chain, Solana, Tron, and NEAR.

The network consistently maintains between 200 million and 250 million active addresses, reflecting rising user engagement. This positions Sei as one of the fastest-growing Layer-1 blockchains in 2025, supported by growing transaction volume and real usage.

DefiLlama data further supports this view, with SEI net inflows doubling month-over-month from 280 million in September to over 650 million tokens in late October. These inflows signal increased investor confidence and improved liquidity across the network.

At the same time, Sei DeFi protocols are gaining momentum, with RWA volume reaching an all-time high of $24 million. Platforms like Yei Finance and Takara Lend are leading this growth, strengthening SEI’s use cases and network activity.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |