Key Insights:

- Bitcoin faces strong resistance at $116K, with analysts eyeing potential correction levels at $105K and $76K.

- Sharpe Ratio data suggests Bitcoin may enter a low-risk phase after recent market volatility.

- October spot trading volume hit $300B, showing traders shifting from leverage to long-term accumulation.

Bitcoin (BTC) remains under pressure as it trades below a key resistance zone of $116K–$117K. Analysts now point to a possible correction if the price fails to break above this level.

Bearish Structure Holds Below $116K

Crypto analyst Crypto Patel reported that Bitcoin has completed a bearish retest at the $116K resistance level. He stated that the market remains bearish, with the price trading below the $116K–$117K zone.

A continued rejection at this range may lead to a decline toward $105K, followed by $93K, and possibly $76K. He noted that if the price continues to reject this level, a corrective move toward $105K, $93K, $ and $76K is likely.

Patel explained that only a confirmed breakout above $117K would change this outlook. Adding that a confirmed breakout above $117K would invalidate the bearish structure and could trigger an extended rally toward $150K+.

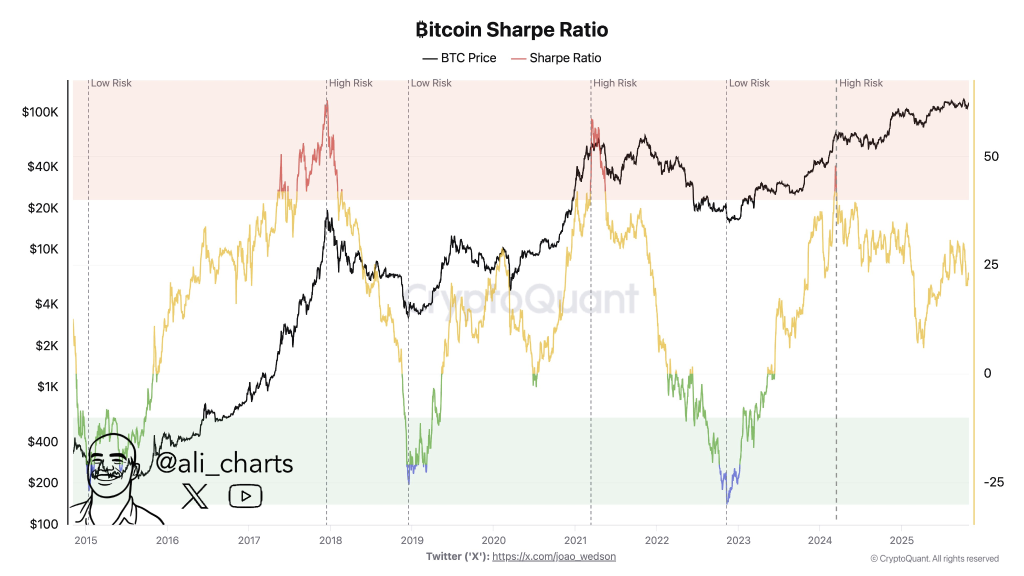

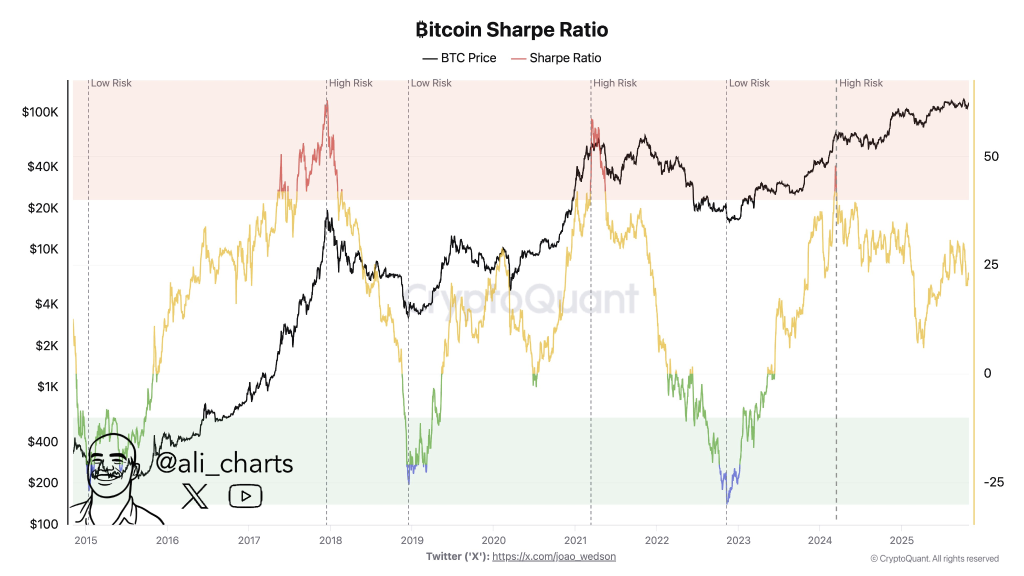

Market Risk Shift And Price Overview

However, Crypto analyst Ali has observed a shift in Bitcoin’s market risk, as indicated by the Sharpe Ratio. The Sharpe Ratio helps measure returns against the risk taken to achieve them.

Bitcoin often rotates between periods of high and low risk. After reaching high-risk territory, a shift toward low risk now looks imminent. No specific price levels were given, but the statement suggests a possible period of lower volatility ahead.

At the time of writting, Bitcoin was priced at $111,265. It is down 1.86% in the past 24 hours. The 24-hour trading volume stands at over $71 billion, reflecting continued high activity in the market.

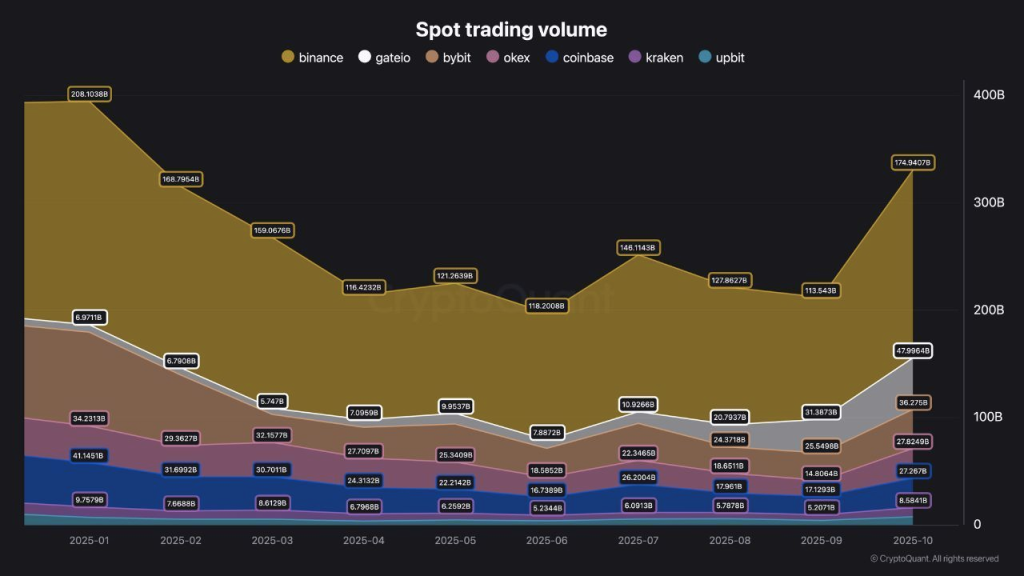

Spot Trading Surges After Market Liquidation

Meanwhile, Bitcoin spot trading volume reached $300 billion in October 2025. Binance contributed $174 billion to this figure. This marked the second-strongest month for spot trading this year. The rise followed the large-scale liquidation event on October 10, which was the biggest in crypto history.

Many traders moved from derivatives to spot Bitcoin. CryptoRus noted that “Leverage isn’t strategy, it’s risk”. Spot trading is often viewed as more stable, with buyers focusing on accumulation and holding positions.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |