Key Insights:

- Ethereum enters Wave 5, targeting above $6K based on Elliott Wave pattern and Fibonacci support.

- Network hits record highs with increased transactions and active addresses, signaling growing demand.

- Large ETH outflows from exchanges suggest reduced sell pressure and long-term accumulation.

Ethereum( ETH) is exhibiting bullish signs, as technical patterns, network metrics, and exchange data indicate strong momentum. Analysts are pointing to a possible move above $6,000 based on current market behavior and patterns.

Ethereum Enters Wave 5 With Technical Support Holding

According to the BitcoinSentiment report, Ethereum is currently in the fifth and final wave of a classic Elliott Wave structure. The Wave 4 retracement found support at a key Fibonacci level, which helped confirm the trend’s continuation.

The Elliott Wave count being followed includes waves (1)-(2)-(3)-(4)-(5). Ethereum is now in Wave 5 of the Elliott Wave structure, which indicates strong bullish momentum. The projected move above $6,000 is based on this established count. This pattern is often used to follow market cycles and behavior.

Ethereum is trading at $3,915.93, with a 24-hour trading volume of over $40.2 billion. The price is down by 2.20% over the last 24 hours. Market watchers continue to closely observe price action, as technical indicators and user behavior suggest potential future price movements.

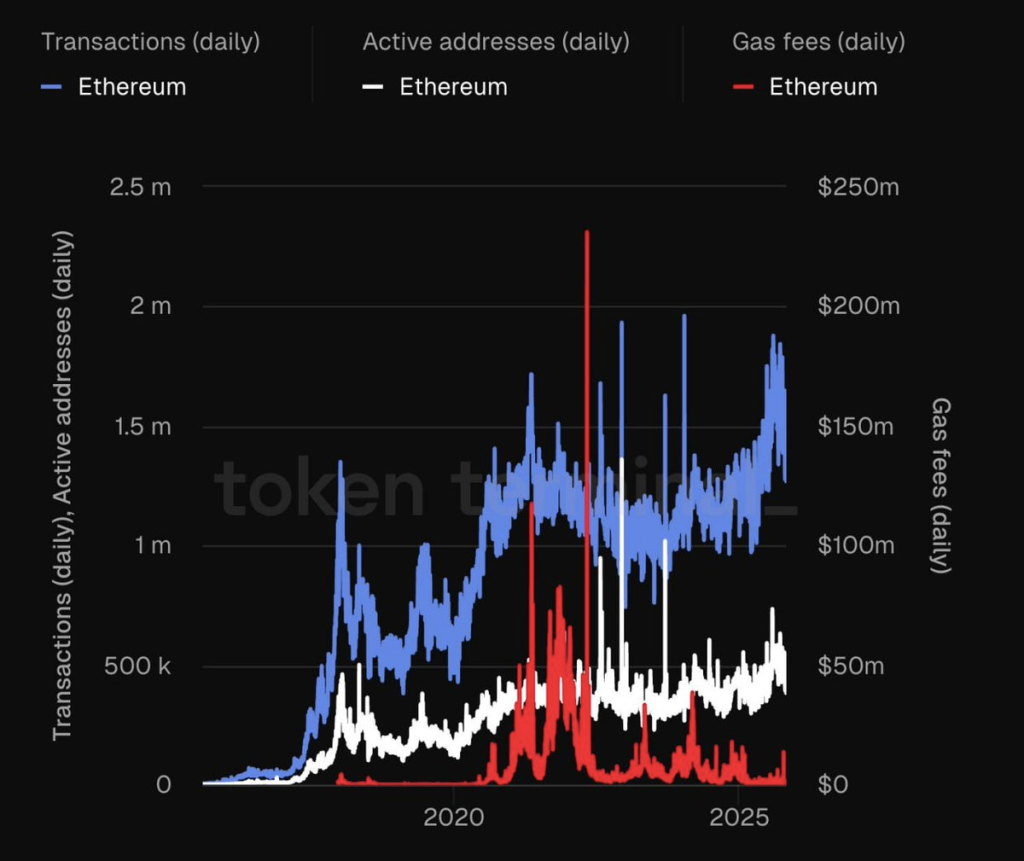

On-Chain Activity Reaches New Highs

Meanwhile, Ethereum’s network is seeing an all-time high in activity. Layer-1 transactions and active addresses are both increasing sharply. This indicates robust network activity and significant usage, reflecting Ethereum’s growing demand and efficiency.

Meanwhile, gas fees remain close to their lowest levels, reflecting improved network efficiency and lower operational costs. Low gas fees, combined with high activity, suggest better efficiency across the network.

These trends suggest more users are transacting on Ethereum while keeping costs low. This level of activity supports growing interest in the blockchain’s core features.

Large ETH Outflows From Exchanges Raise Market Focus

Furthermore, approximately 200,000 ETH valued at $780 million were withdrawn from exchanges in just 48 hours. These movements are often watched closely by market participants. Withdrawals from exchanges are sometimes seen as users moving assets to long-term storage.

This reduces the amount of ETH available for trading, which may influence price trends. The motive behind these withdrawals is not confirmed, though the timing aligns with higher on-chain activity.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |