- U.S. and China agree on tariff suspensions and export control measures.

- Stability expected in the global economy.

- Positive shift in agricultural trade and economic cooperation.

China and the United States finalized trade negotiations in Kuala Lumpur on October 30, reaching consensus on tariffs and bilateral cooperation, poised to impact global markets.

The agreement provides economic stability and may influence cryptocurrency markets indirectly by affecting global risk sentiment and trade-related confidence.

Major U.S.-China Trade Agreements Announced in Kuala Lumpur

China and the United States have reached significant trade agreements involving the removal of a 10% fentanyl tariff on Chinese goods by the U.S., alongside a suspension of the 24% retaliatory tariff. These agreements, made during consultations in Kuala Lumpur, aim to reduce trade tensions between the two nations.

Both countries have decided to suspend export controls for one year, including a key U.S. 50% penetration rule, and have paused Section 301 investigations into Chinese industries (source). China agreed to suspend corresponding measures for the same period. The U.S. has made commitments in the investment sector, while China focuses on resolving issues related to TikTok. Such steps are designed to bolster economic stability and bilateral trade relations.

Market reactions have been largely optimistic, with officials noting the potential for expanded agricultural trade and easing of rare earth export controls. U.S. Treasury Secretary Scott Bessent highlighted the successful framework achieved, while Chinese Vice Minister Li Chenggang emphasized its role in stabilizing trade relations. Leaders from both nations are set to further discuss these results.

Scott Bessent, Treasury Secretary, U.S.: “I think we have a very successful framework for the leaders to discuss on Thursday. The talks were very substantial negotiations, and the outcome will be presented to both presidents for their consideration.”

Analysis of Historical Agreements and Market Effects

Did you know? Historical trade agreements, such as the Phase One deal from 2019-2020, often inspire short-term market optimism, reflecting similar initial reactions to current tariff suspensions.

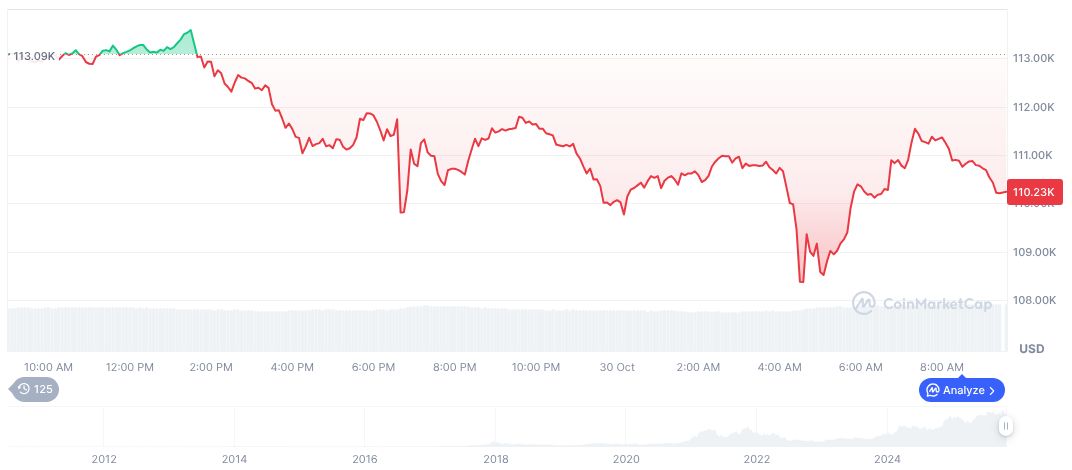

Bitcoin (BTC) currently trades at $108,312.86, with a market cap of $2.16 trillion, a 3.77% decrease over 24 hours and a 1.22% loss over the past week. Data from CoinMarketCap indicates BTC’s dominance stands at 59.15%, while its 24-hour trading volume reached $76.68 billion.

Coincu’s research team suggests that these trade agreements could stabilize the global economy, potentially influencing liquidity flows in the crypto market. Historical data reveals that easing trade tensions often leads to increased investment in both digital and traditional markets.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |