Key Insights:

- Ondo integrates Chainlink to bring secure, real-time pricing to over 100 tokenized stock assets.

- Chainlink’s CCIP has become a preferred cross-chain solution for financial institutions using Ondo’s platform.

- Partnership supports tokenized market growth with accurate data and institutional-grade interoperability tools.

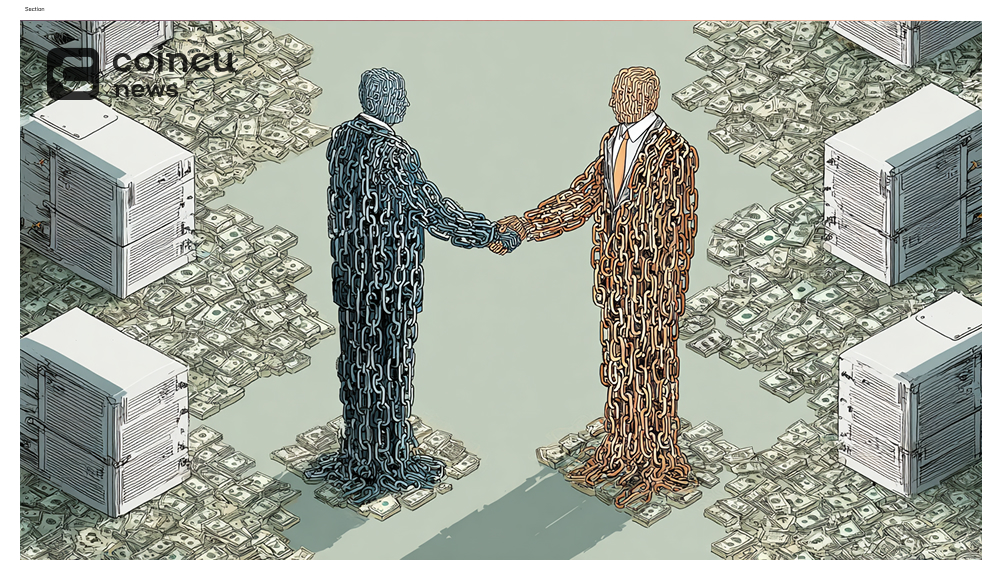

Ondo Finance has chosen Chainlink to provide the oracle infrastructure for its regulated tokenized stocks platform. The integration also makes Chainlink’s Cross-Chain Interoperability Protocol (CCIP) the preferred solution for financial institutions working with Ondo across blockchain networks.

Chainlink to Power Pricing and Data Feeds

Chainlink will deliver secure, real-time price feeds for more than 100 tokenized assets listed through Ondo Global Markets. These include tokenized stocks and ETFs, with over $300 million in total value locked. The data feeds capture market prices and corporate actions like dividends, allowing for accurate valuations onchain.

Each asset will use custom feeds supported by Chainlink’s infrastructure. This setup enables consistent pricing across DeFi protocols, collateralized vaults, and other tokenized financial products. Nathan Allman, CEO of Ondo Finance, said, “By adopting Chainlink as the official oracle infrastructure for our tokenized stocks, we’re making our tokenized assets seamlessly composable across DeFi and institutional rails.”

Institutional Access and Market Expansion

The partnership will support new services for financial institutions looking to move assets onchain. Ondo’s ecosystem spans 10 blockchains and over 100 integrated applications. Chainlink’s CCIP will help these firms access cross-chain infrastructure for their tokenized securities and transactions.

Chainlink has also joined the Ondo Global Market Alliance and Ondo’s corporate actions initiative, working alongside Swift, DTCC, Euroclear, and other major financial organizations. The goal is to support institutional activity onchain with secure pricing, data access, and interoperability.

Infrastructure for Tokenized Markets

Chainlink’s role includes maintaining a consistent data standard for tokenized assets issued by Ondo. This will allow funds, asset managers, and protocols to interact with tokenized stocks in a programmable and secure way.

Sergey Nazarov, Co-Founder of Chainlink, said,

“Ondo’s deployment of tokenized stocks using Chainlink showcases what institutional-grade tokenized stocks look like in production.”

The integration offers broader access to tokenized markets for institutions and developers, supporting lending, settlement, and new financial products across blockchain networks.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |