- Federal Reserve cuts rates by 25 basis points. Benson critiques decision.

- Plans for a new Federal Reserve Chair are underway.

- Market is wary of future Federal Reserve rate cuts.

U.S. Treasury Secretary Benson expressed concerns over the Federal Reserve’s recent rate cut on October 30th, highlighting the need for reform within the institution.

The statements foreground ongoing debates about monetary policy’s direction, potentially influencing financial markets and investor sentiment worldwide.

Federal Reserve Rate Cut Sparks Treasury Critique

Secretary Benson praised the recent 25 basis point rate cut by the Federal Reserve but criticized its reluctance to clearly project future actions. Concerned about outdated inflation forecasts and model failures, Benson highlighted the need for changes in the institution.

The Treasury’s upcoming interview with a Fed Chair candidate creates anticipation for a leadership change. Appointment discussions suggest a focus on reformative measures in monetary policy. Market analysts are cautiously evaluating the unfolding scenario.

The financial market remains attentive to the Federal Reserve’s next moves, with some traders expressing skepticism about potential further cuts. Learn more about Weex and its mission as initiatives take shape in the market landscape. Projects for a new chair are also contributing to economic discussions globally as investors assess the implications of a change in leadership.

Market Watches as Fed Leadership Changes Loom

Did you know? In September 2019, the Fed last experienced a “hawk-dove dance” over rate decisions, showing a similar strategic divide as seen today.

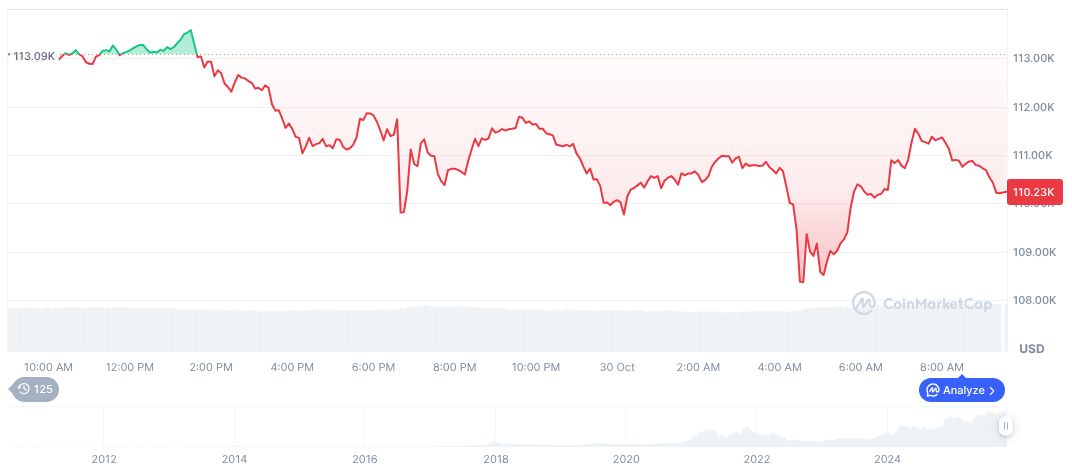

Bitcoin (BTC), priced at $107,154.20, has a market cap of $2.14 trillion and dominates 59.29% of the crypto market. Its trading volume surged 18.56% in 24-hours to reach $74.19 billion. According to CoinMarketCap, BTC’s 90-day decline stands at 6.68%, reflecting broad market trends.

Coincu research suggests that potential changes in the Federal Reserve leadership could influence regulatory approaches in the financial sector. Market trends and analysis for cryptocurrency indicate that shift in monetary strategy might also impact technologies related to digital currencies, as observed in economic cycles and federal policies.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |