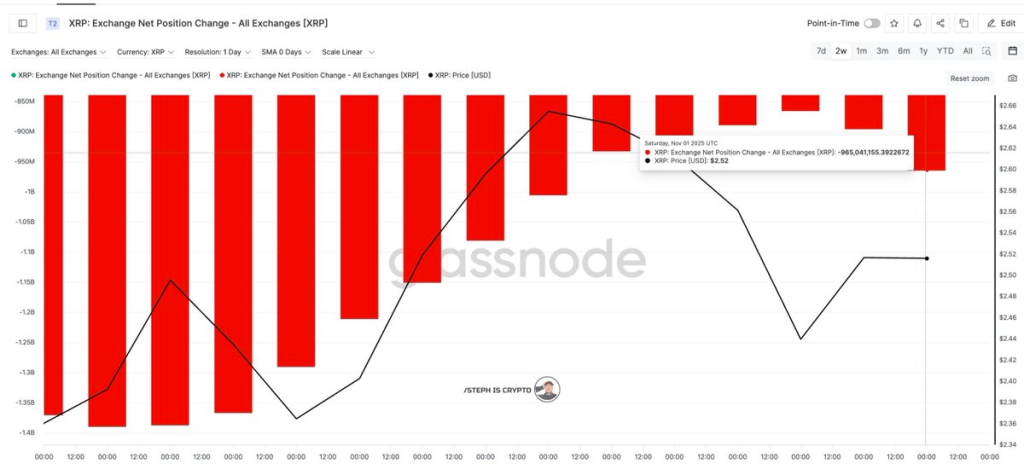

Key Insights:

- XRP exchange balances dropped by 965M, reducing supply available for short-term trading or selling.

- XRP price holds above the 20-month EMA at $1.96, maintaining its long-term bullish structure.

- Monthly RSI forms a wedge, echoing previous setups that preceded sharp price moves in past cycles.

XRP balances on exchanges have declined by over 965 million tokens, marking one of the largest net outflows recorded in recent weeks. The data, tracked across all major trading platforms, shows that more XRP is being withdrawn than deposited, reducing the supply available for immediate sale.

This ongoing trend points to holders moving assets into private wallets. Such movement is often associated with longer-term positioning. As one market watcher commented, “Less supply on exchanges = bullish pressure.” For now, the reduced supply has not triggered a breakout in price.

Market Price Remains Stable Around $2.53

XRP was trading at $2.53, reflecting a 1.5% increase in the past 24 hours. The weekly performance shows a 4.3% decline, suggesting that recent outflows have not yet shifted momentum. Daily trading volume stands at $1.92 billion, keeping liquidity levels steady.

Although supply on exchanges is falling, price remains range-bound. Without fresh buying, the market has yet to respond. One trader noted, “Outflows are strong, but the market still needs confirmation from demand.”

Structure Holds Above Long-Term Support

XRP continues to trade above the 20-month exponential moving average, currently near $1.96. This level has served as long-term support since the breakout earlier in the year. Price holding above it keeps the broader structure intact.

Fibonacci projections from the recent breakout place future targets at $8.43, $13.64, and $27.24. These levels follow the same approach used in previous cycles, including the 2017 rally. As long as the $1.96 level holds, these targets remain valid.

RSI Cooling After Earlier Surge

The monthly RSI has pulled back after reaching elevated levels earlier this year. A wedge pattern is forming on the RSI, similar to what was seen in past rallies. This kind of setup previously led to strong upward moves once broken to the upside.

“RSI is cooling off in a wedge, just like before the last major rally,” one analyst said. If the pattern holds, XRP could be setting up for a larger move. For now, traders are watching price levels and demand closely.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |