In Brief

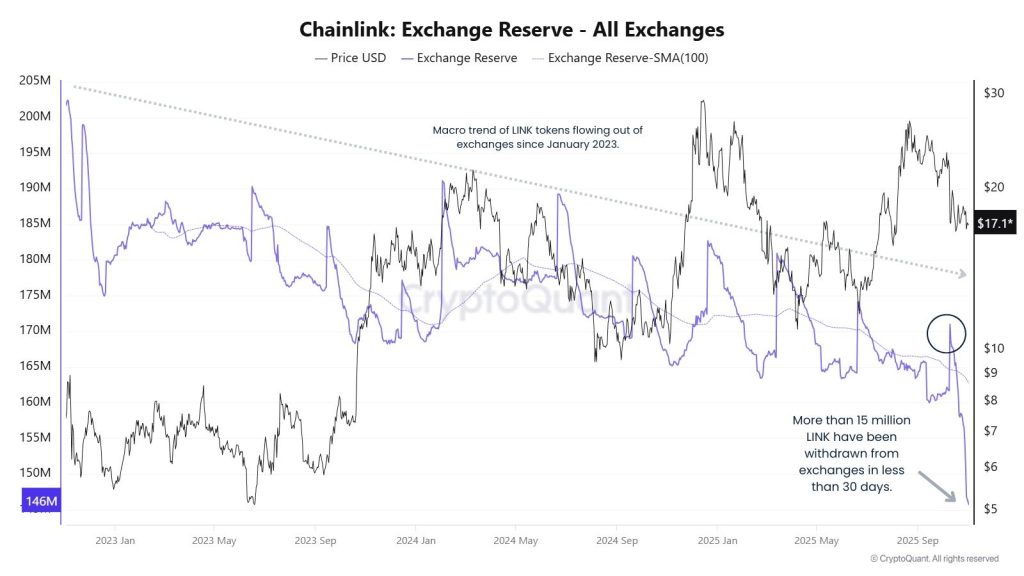

- Over 15M LINK withdrawn from exchanges in 30 days, signaling strong accumulation activity.

- LINK forms bullish triangle pattern; analysts eye breakout from $15 support to higher targets.

- Chainlink adoption grows with 62 integrations across 24 chains, boosting long-term demand outlook.

Chainlink is showing signs of a potential supply squeeze as exchange reserves fall to multi-year lows. More than 15 million LINK tokens have been withdrawn from exchanges within the past 30 days, according to CryptoQuant data.

This large withdrawal trend has accelerated a long-term pattern of decreasing LINK reserves that started in early 2023. Reduced exchange supply often indicates accumulation, as investors move tokens into private wallets for long-term holding.

This outflow may signal a phase of strong accumulation, which could support price stability. The macro downtrend in available LINK supply aligns with rising institutional and protocol-level activity across the Chainlink ecosystem.

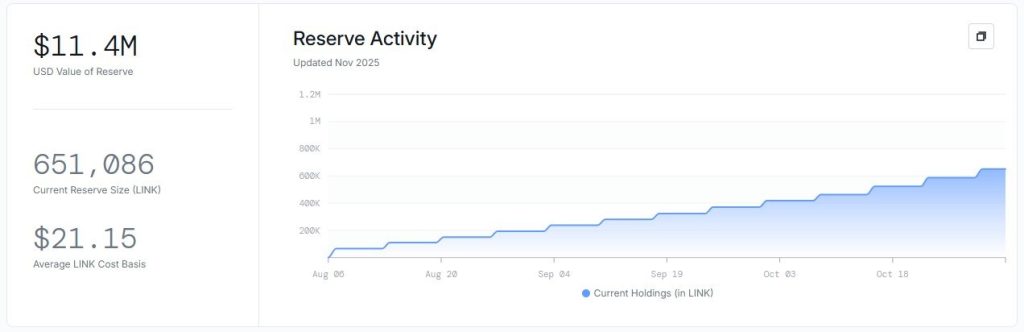

Supporting this broader accumulation trend, the official Chainlink Reserve has steadily grown its holdings to over 651,000 LINK, worth around $11.4 million. With an average cost basis of $21.15, the reserve’s behaviour reflects long-term confidence in the token’s value.

Technical and adoption signals support a bullish long-term outlook

At press time, LINK was trading around $17.08, reflecting a 9.15% decline over the past week despite a slight intraday gain. This minor rebound highlights market resilience, even after a pullback from October’s local high near $20.

Moreover, analyst ali_charts shared a chart showing LINK forming a long-term symmetrical triangle on TradingView. He identified a potential dip toward $15 as a buying zone before a projected breakout that could extend toward $100.

Technical structures and on-chain data together suggest consolidation ahead of a possible expansion phase. The $15–$17 range now acts as a key accumulation area for traders positioning for future strength.

Chainlink adoption continues to grow, with 62 integrations recorded this week across 24 blockchains, according to Chainlink’s latest update. Expanding cross-chain utility strengthens the project’s fundamental base and supports sustained demand for LINK tokens.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |