- Coinbase Institutional outlines potential cryptocurrency market recovery in December.

- Reduced leverage and improved liquidity cited.

- Focus on Bitcoin, Ethereum, and Solana.

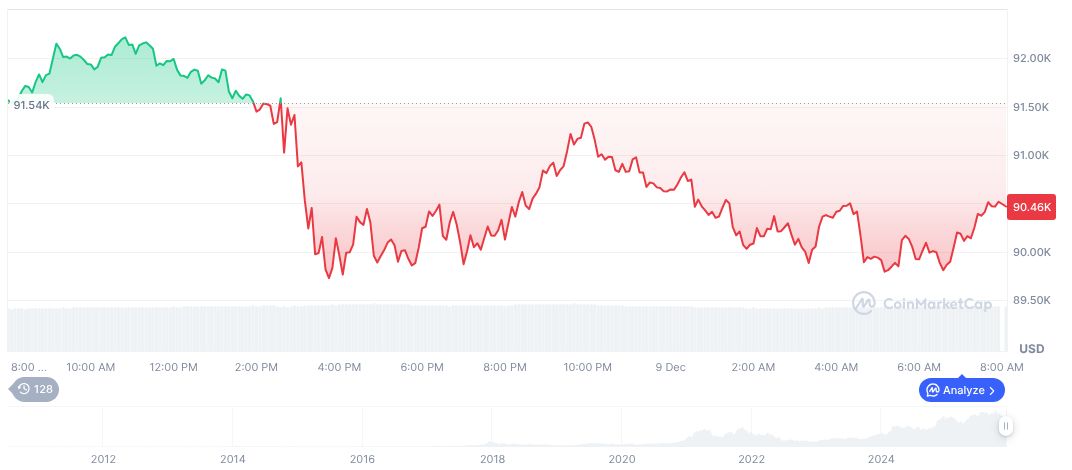

Coinbase Institutional suggests November’s market turbulence, marked by reduced BTC, ETH, SOL positions, could signal a healthier December for cryptocurrencies, per research published on December 10.

Systemic leverage declines and deflated speculative bubbles offer a robust market structure, hinting at potential stability and growth for December, impacting BTC, ETH, and SOL.

Coinbase’s December Outlook: Leverage Reduction and Liquidity Gains

Coinbase Institutional released a report indicating a possible December recovery in the cryptocurrency market. This assessment stems from improved liquidity conditions and substantial reductions in leverage throughout November. The report points to strategized market positioning by institutional investors.

The cautious optimism in markets is driven by key factors such as the likelihood of Federal Reserve rate cuts and an improved macroeconomic environment. These conditions have steered Bitcoin, Ethereum, and Solana into the spotlight as assets likely to gain from any rebound.

“Leverage and speculative excess were flushed, leaving a healthier market backdrop going into December.” — Coinbase Institutional Research Team, Source

Historical Reduction Patterns Signal Potential Recovery

Did you know? In past instances, a significant reduction in market leverage has often precipitated a rapid recovery across major cryptocurrencies, particularly Bitcoin, as documented in previous cycles observed during the 2020 and 2021 periods.

According to CoinMarketCap, Bitcoin’s latest metrics show a market capitalization of 1.85 trillion and a 58.44% dominance. With a current price of $92,562.61, Bitcoin has seen a 2.80% increase over the last 24 hours, though it has declined by 18.97% over 90 days.

Coincu’s research team indicates that reduced leverage typically precedes stabilization and potential growth in crypto markets. Historical analysis suggests that foundational market changes present long-term opportunities. Stability, combined with positive economic shifts, may lead to meaningful advancements in adoption.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |