- PBC emphasizes digital RMB progress and global governance participation.

- PBC aims to strengthen financial security and RMB internationalization.

- Market may view the digital RMB push as a strategic financial emphasis.

On December 12, the People’s Bank of China emphasized advancing financial openness and digital renminbi at a Party Committee meeting in Beijing, aligning with global financial governance reform initiatives.

This approach highlights China’s commitment to integrating RMB internationalization with financial security, potential impacts on cross-border payments, and emerging digital RMB structures, without affecting existing cryptocurrency markets directly.

PBC Announces Strategic Moves for Digital RMB Integration

Pan Gongsheng, Governor, People’s Bank of China (PBC) – “The Central Economic Work Conference (CEWC) will focus on implementing policies that support RMB internationalization and the development of a digital RMB.”

China’s initiatives in digital currencies trace back to the January 2020 launch of e-CNY trials, signifying its longstanding commitment to a technology-driven financial future.

Experts at Coincu observe that China’s move towards RMB digitalization could shift regulatory landscapes globally. The strategic growth in digital currencies may influence multilateral transactional frameworks, potentially redefining financial operations globally.

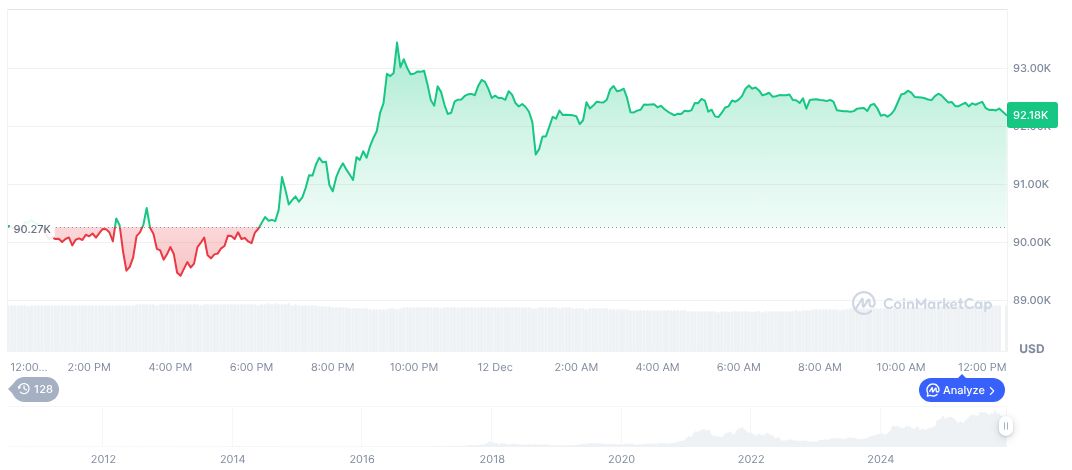

Market Overview and Bitcoin Insights

Did you know? The digital RMB is part of China’s broader strategy to modernize its financial system and enhance its role in global finance.

Bitcoin (BTC) is currently valued at $92,229.47, with a market cap of $1.84 trillion and 24-hour trading volume showing a 1.85% change. Its dominance in the market stands at 58.69%, reflecting its resilience despite recent price dips over 30, 60, and 90 days. Data source: CoinMarketCap.

Experts at Coincu observe that China’s move towards RMB digitalization could shift regulatory landscapes globally. The strategic growth in digital currencies may influence multilateral transactional frameworks, potentially redefining financial operations globally.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |