- Strategy Inc. retains Nasdaq-100 spot; strategic Bitcoin approach reaffirmed.

- Secure Nasdaq-100 spot supports market visibility.

- Market positioning strengthens BTC investment narrative.

Strategy will remain on the Nasdaq‑100 index for another year, maintaining its role as a major Bitcoin treasury holder through its buy-and-hold BTC model, reports Reuters.

This sustains the passive-index demand for MSTR, emphasizing Strategy’s alignment with Bitcoin investment trends and potentially affecting market sentiment toward corporate BTC adoption.

Nasdaq-100 Status Solidifies Bitcoin Market Strategy

Strategy Inc. will remain on the Nasdaq-100 Index for another year. This decision comes as a reflection of the company’s robust Bitcoin-centered business model. Michael Saylor, as the Executive Chairman, and Phong Le, President and CEO, continue driving Strategy as a prominent Bitcoin treasury firm. According to Michael Saylor, “Strategy describes itself as building a BTC reserve and gives explicit Bitcoin yield and gain targets for FY2025.” Strategy Press Release

The decision to keep Strategy in the Nasdaq-100 index highlights the market’s acceptance of its Bitcoin buy-and-hold strategy. This action underscores Strategy’s augmented role as a major BTC holder, utilizing capital acquisitions to fortify its position in the market.

Industry observers often view Strategy as a leveraged Bitcoin investment vehicle. While there are no direct quotes from executives regarding the index decision, the market perceives MSTR as a proxy for Bitcoin exposure.

Bitcoin Price Dynamics and Expert Insights

Did you know? Many public companies have attempted to emulate Strategy’s BTC-centric strategy. However, Strategy remains the largest public BTC holder, influencing the corporate Bitcoin adoption narrative.

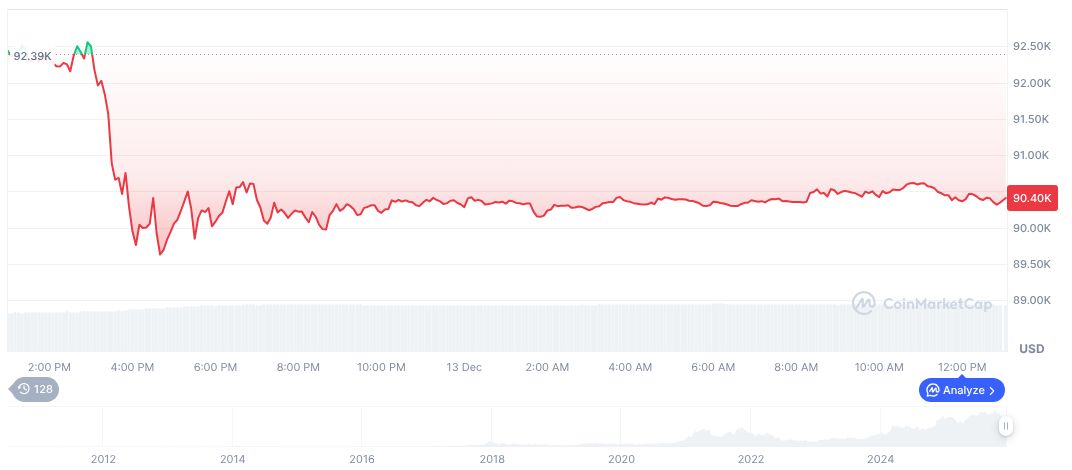

According to CoinMarketCap, Bitcoin’s price currently stands at $90,108.49, with a market cap of $1.80 trillion, representing a market dominance of 58.55%. Bitcoin’s price has slightly decreased by 0.28% over the last 24 hours, while showing a 0.87% increase over the past seven days. The current circulating supply sits at 19.96 million BTC, nearing its maximum supply of 21 million.

Coincu research analysis suggests that Strategy’s prominence on the Nasdaq-100 enhances its visibility and may catalyze further BTC accumulation and investment. The company’s strategic positioning reinforces investor confidence in Bitcoin as a notable financial asset.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |