- MicroStrategy maintains a strong position in Nasdaq 100 despite Bitcoin strategy scrutiny.

- Market analysts view this as an indicator of Bitcoin’s corporate entrenchment.

- Bitcoin’s market volatility is a concern for traditional financial sectors.

MicroStrategy will remain in the Nasdaq 100 index following the annual adjustment, effective December 22, as announced by Nasdaq on December 12, 2025.

This retention reaffirms MicroStrategy’s commitment to its Bitcoin-focused strategy despite facing criticism, influencing BTC market sentiment due to its substantial holdings.

Market Reactions and Future Implications for BTC Strategy

MicroStrategy, famous for its strategic pivot to Bitcoin in 2020, was re-confirmed as part of the Nasdaq 100 index. Under Executive Chairman Michael Saylor, the company holds 660,624 Bitcoins, reflecting a strategic focus shift from software solutions.

In terms of immediate implications, the firm continues to challenge standard business norms, emphasizing Bitcoin as its principal treasury asset amid ongoing critics from financial sectors. The retention in the index underscores investment community interest, despite the volatility concerns.

In response to this retention, Michael Saylor remarked that BTC accumulation will proceed until critical voices subside. Market analysts view this continued index presence as indicative of Bitcoin’s entrenchment in corporate strategies, persuading skeptics of Bitcoin’s viability.

Historical Context, Price Data, and Expert Analysis

Did you know? MicroStrategy’s inclusion in Nasdaq 100 last December was a pivotal moment showcasing institutional validation of cryptocurrency strategies despite traditional financial criticisms.

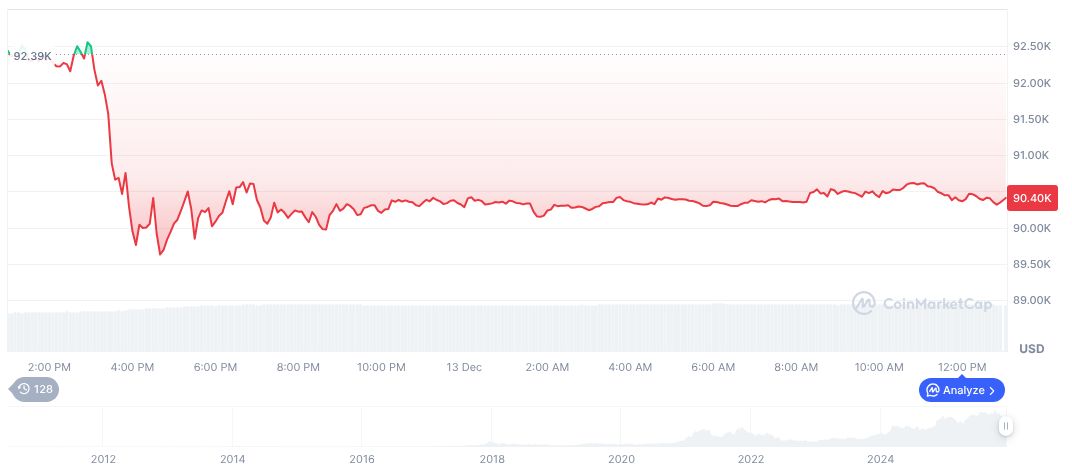

According to CoinMarketCap, Bitcoin’s current price is $90,329.66 with a market cap of $1.80 trillion and a 24-hour trading volume dropping by 20.56% to $63.79 billion. Recent months see BTC prices down by 9.34% over 30 days, marking volatile market dynamics.

Insights from the Coincu research team suggest that MicroStrategy’s steadfast commitment to BTC might encourage more traditional companies to consider cryptocurrency investments. Regulatory developments also play a role, with scrutiny levels potentially affecting institutional confidence in the current BTC-focused strategy.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |