- Kevin Warsh’s nomination odds for Fed Chairman rise sharply.

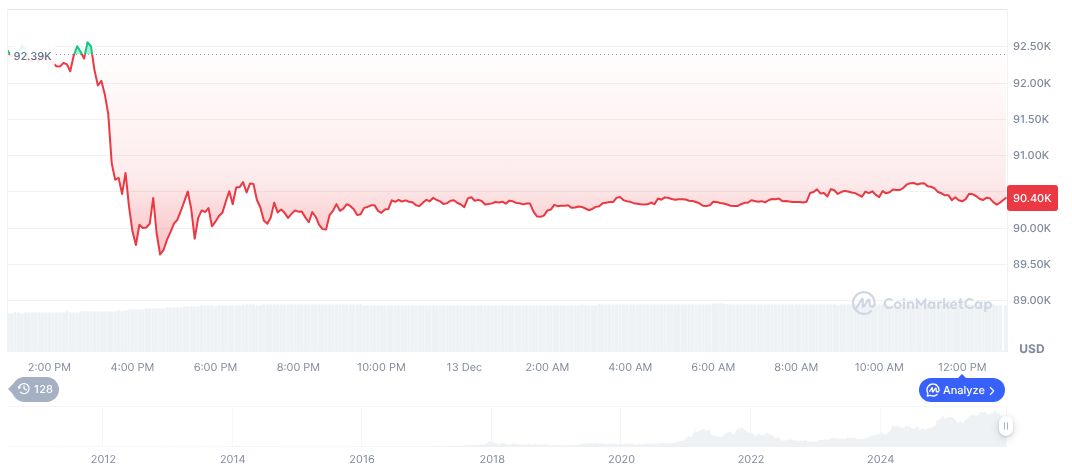

- Markets respond with adjusted forecasting statistics.

- Trump considered both Kevin Warsh and Kevin Hassett as top contenders.

Former Federal Reserve Governor Kevin Warsh has emerged as a top contender for Federal Reserve Chairman, with his nomination probability rising significantly on prediction markets as of December 14.

Warsh’s increased odds signify potential shifts in Federal Reserve policy direction, capturing attention amid pivotal economic circumstances. Markets respond but without immediate impacts on cryptocurrency assets.

Warsh’s Rising Odds and Market Shifts

On December 14th, prediction markets showed a marked rise in the probability of Kevin Warsh’s nomination as Federal Reserve Chairman. Polymarket and Kalshi indicated increased odds from previous values, reflecting significant interest in Warsh’s potential leadership.

In direct contrast, Kevin Hassett’s nomination probability exhibited a downward trend after maintaining higher levels previously. This change highlights a shift in market sentiment towards Warsh being a stronger candidate for the position.

Donald Trump, President of the United States, – “Yes, I think he is. I think you have Kevin and Kevin. They’re both – I think the two Kevins are great,” and added, “I think there are a couple of other people that are great.” Source

Federal Reserve Chairmanship’s Effect on Cryptocurrencies

Did you know? In previous Federal Reserve leadership changes, market predictions have played a crucial role in shaping investor expectations, affecting stocks and bond yields significantly, yet similar effects on cryptocurrencies remain speculative.

Bitcoin (BTC) currently trades at $90,320.85, with a market cap of $1.80 trillion. It dominates 58.61% of the cryptocurrency market. The 24-hour trading volume dropped to $64.61 billion, marking a 20.70% decrease. Prices have risen 8.34% over the past 24 hours, but declined by over 21% in 90 days.

The research team from Coincu suggests potential shifts in Federal Reserve policy under new leadership could impact financial decision-making, but the direct implications on cryptocurrencies remain uncertain. The historical analysis emphasizes reliance on broader economic trends and regulatory environments.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |