- Rodney Burton charged for promoting HyperFund scam involving $1.8 billion.

- Co-defendant has pleaded guilty; another co-founder remains at large.

- Potential 20-year imprisonment for Burton on multiple federal charges.

Rodney Burton, known as “Bitcoin Rodney,” faces 11 federal charges for promoting the $1.8 billion HyperFund scam, with proceedings in the Southern District of Maryland.

The indictment highlights ongoing regulatory challenges in the cryptocurrency sector, emphasizing risks in crypto investments lacking regulatory oversight.

Burton’s Alleged Misuse of $1.8 Billion Investor Funds

The U.S. Attorney’s Office for the Southern District of Maryland charged Rodney Burton for allegedly promoting the HyperFund scam between June 2020 and May 2024. Burton, also known as “Bitcoin Rodney,” faces serious allegations involving conspiracy, wire fraud, and money laundering. If convicted on all counts, Burton could face up to 20 years in federal prison.

Prosecutors allege that Burton misused investor funds from HyperFund, an investment scheme promising false returns, to fund his personal lifestyle. This involved purchasing luxury items, highlighting a misuse of the $1.8 billion reportedly scammed from investors. According to the U.S. Attorney’s Office:

the maximum penalties include up to 20 years per wire fraud count, 10 years per money laundering count, and 5 years for unlicensed transmission. Department of Justice

The charges underscore efforts to crack down on fraudulent crypto schemes.

Community reactions have varied, with some expressing satisfaction at the legal actions taken, while others await further developments. The absence of significant market impact is noted, as HyperFund’s fraudulent nature was previously recognized by major crypto entities.

Cryptocurrency Markets React to Regulatory Efforts

Did you know? Rodney Burton’s indictment adds to the growing list of crypto scam cases. In recent years, federal agencies have intensified efforts to combat crypto fraud, leading to increased legal scrutiny.

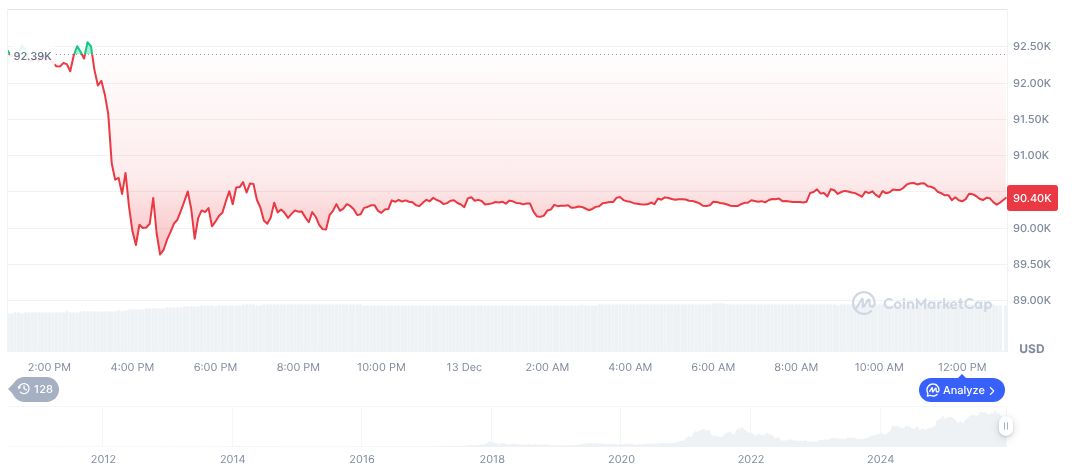

According to CoinMarketCap, Bitcoin (BTC) currently trades at $90,203.93, with a market cap of approximately $1.80 trillion. Its dominance is at 58.65%, despite a 0.16% decline over 24 hours. The currency continues to experience bearish trends over the past 90 days, with a 22.61% decrease in price.

The Coincu research team suggests that increased regulatory measures could result from this and similar cases, potentially impacting future technological innovations in blockchain. Enhanced oversight may also lead to initial resistance but promises safeguards against fraudulent schemes.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |