- China proposes crypto crime disposal framework, enhancing legal processes for virtual assets.

- Framework to streamline judicial procedures and asset recovery.

- No immediate market reaction observed from global crypto leaders.

The Justice Network has released a proposal to enhance judicial paths for managing criminal cases involving virtual currency, emphasizing new legal and procedural standards for third-party auction assistants in China.

This proposal aims to safeguard against speculative return channels, standardize asset disposal, and protect victims, potentially reshaping judicial processes in the evolving digital currency landscape.

China’s Proposal: Clear Framework for Crypto Asset Management

The new proposal from the Justice Network emphasizes a need for clear legal frameworks and technical standards in crypto crime cases. The authors, members from influential legal and academic institutions, propose third-party involvement in auctions of seized assets, along with dual technical standards for evidence handling.

Changes include the establishment of third-party institutions as auction assistants and a dual system for evidence storage and financial disposition. The plan addresses asset recovery and market re-entry prevention.

There has been no significant reaction from key figures in the global crypto community. The lack of response might indicate this is viewed as a regional concern with limited immediate international impact.

China’s Legal Reform: Potential Global Impact on Crypto Regulation

Did you know? China’s approach to virtual currency involvement in crime is among the few initiating explicit legal reforms, aiming to provide a structured disposal process while avoiding market repercussions through judicial oversight.

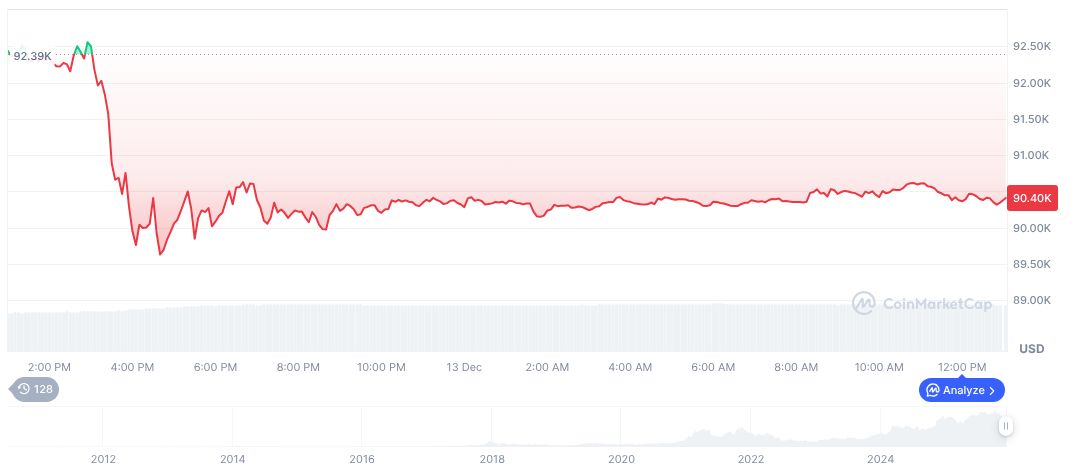

Bitcoin (BTC) continues to dominate the market with a 58.64% share, valued at $90,162.71 per BTC as of December 14, 2025. Despite a major market cap of $1.80 trillion, its price decreased by 22.42% over three months, according to CoinMarketCap.

Coincu’s research team suggests that China’s judicial framework could set a precedent for international regulatory strategies in cryptocurrency legal proceedings. By emphasizing standardization and targeted asset recovery, China may influence global policies.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |