- The FedWatch tool indicates a 75.6% chance of unchanged rates in January 2026.

- Possible interest rate cut of 24.4% in January 2026.

- Uncertainty remains for crypto markets and economic forecasts.

Data from CME’s FedWatch on December 14 indicates a 24.4% chance of a 25bps rate cut by January’s FOMC meeting and 75.6% chance of no change.

These probabilities could influence market expectations for interest rates, potentially affecting investment strategies and asset valuations in the cryptocurrency and broader financial markets.

FedWatch Predicts 75.6% Stability in Interest Rates

CME FedWatch highlights a 75.6% probability of interest rates remaining unchanged in the January 2026 FOMC meeting. The data also indicates a 24.4% chance of a 25 basis points rate cut at that meeting. Observers are closely monitoring these projections.

The high probability of no change suggests limited expectations for rate adjustments. This forecast could signal limited impact on mainstream assets such as Bitcoin, Ethereum, and stock markets in the short term.

Historically, expectations around interest rate changes have sometimes led to increased crypto market volatility. Continued analysis and observation remain essential.

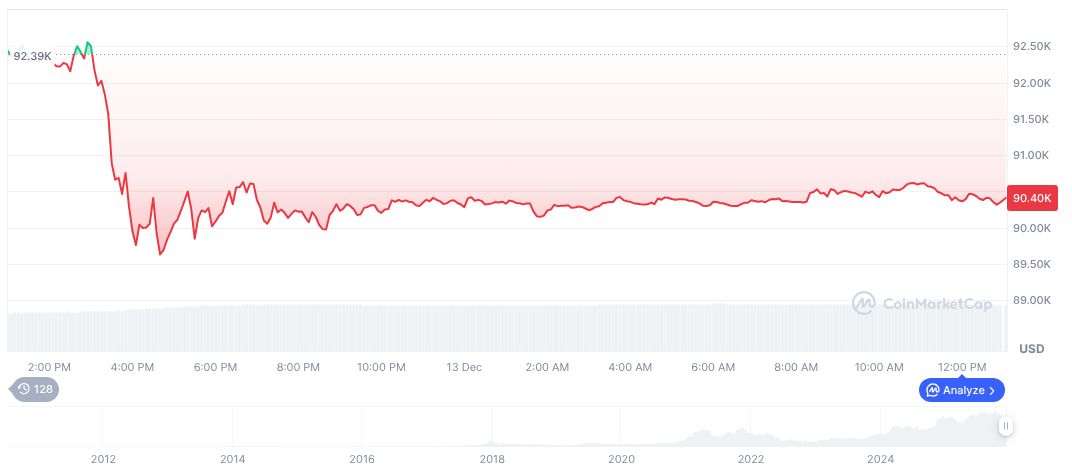

Bitcoin Remains Stable Amid Interest Rate Projections

Did you know? The FedWatch tool’s current projections mark the first time since mid-2023 that the chance of a rate cut has risen above 20% for a scheduled Fed meeting, potentially reflecting evolving economic conditions.

Bitcoin (BTC) is trading at $90,140.25, with a market cap of $1.80 trillion and a dominance of 58.63%, as reported by CoinMarketCap. Although its price decreased by 0.28% in the last 24 hours, it’s up 0.84% over the past 7 days. Total trading volume reached $65.28 billion over 24 hours.

Despite the FedWatch tool’s insights, renowned market figures have not publicly commented on these probabilities. Analysts suggest that cryptocurrency volatility remains. Additionally, policymakers have yet to offer viewpoints.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |