Bitcoin Faces Critical Support at $82,800 Amid Bearish Sentiment

In Brief

- Bitcoin nears $82,800 support, with possible bearish implications.

- Long-term holders show unrealized losses as BTC struggles.

- $74,000 level emerges as a crucial support zone for Bitcoin.

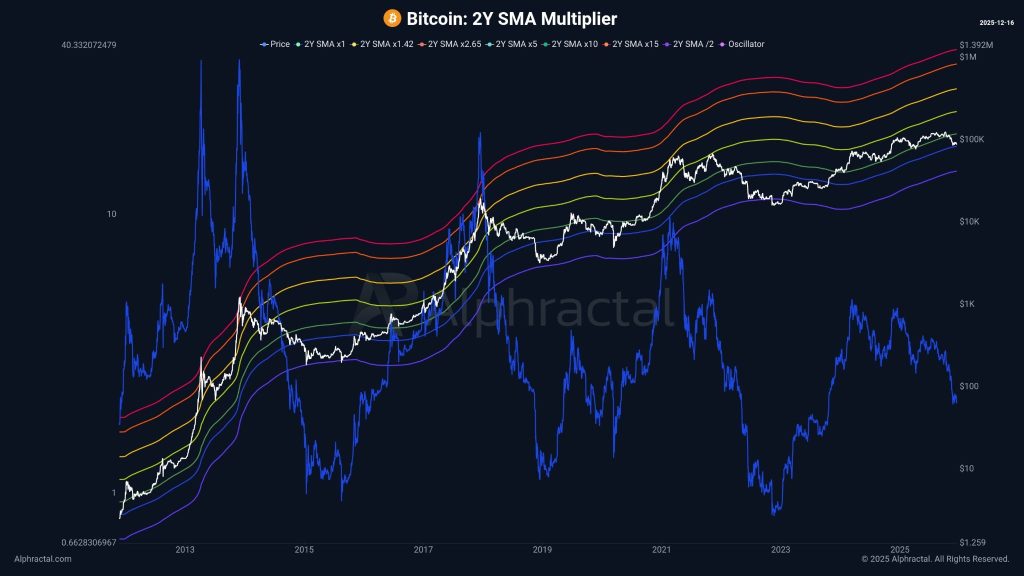

Bitcoin is currently testing the critical $82,800 level on the 2-Year Simple Moving Average (SMA) Multiplier. This support zone has historically acted as a pivotal point for price movements, with Bitcoin’s performance around this area often signaling significant market shifts.

If BTC fails to close above this level by December 31, 2025, it may confirm a bearish trend, as past data shows prolonged downtrends following a close below the 2Y SMA.

The 2Y SMA Multiplier chart is widely respected for its ability to predict Bitcoin’s market cycles. Historically, when Bitcoin falls below this line, it has extended bear markets with sustained downward pressure.

In contrast, rejections from the upper bands of the 2Y SMA often precede major bullish trends. Currently, BTC’s position near the lower zone highlights a critical moment in its cycle.

Long-Term Holders Show Unrealized Losses Amid Price Struggles

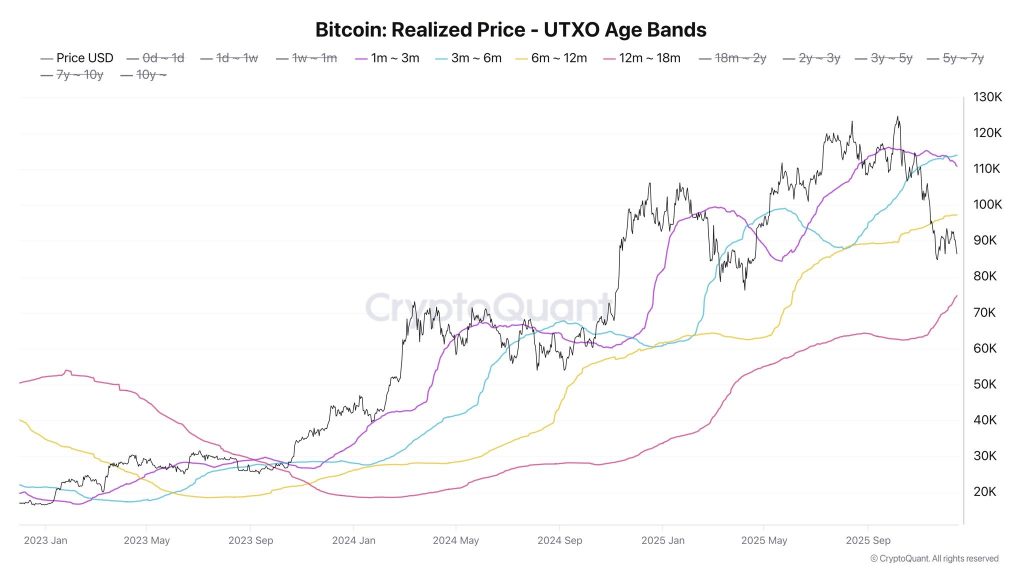

Meanwhile, long-term Bitcoin holders (LTH) are currently facing losses, with the 6-12 month cohort showing an average unrealized loss of 11.6%. This is due to BTC trading at approximately $86,000, well below the $97,320 average cost basis for this group.

Despite this, many LTHs continue to hold their positions, which could signal confidence in a market rebound. However, if this trend continues, it could signal broader market weakness.

In contrast, the 12-18 month UTXO (Unspent Transaction Output) cohort has seen its cost basis increase significantly since November 1st. This suggests that older holders are absorbing losses while newer holders at a lower price point may provide support at the $74,000 level.

As a result, $74,000 is now seen as a strong technical level, which is likely to play a critical role in the near-term price action.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |