Chainlink Whales Accumulate LINK Tokens as ETFs See Consistent Inflows

In Brief

- Chainlink whales accumulate 20.46 million LINK, signaling confidence.

- LINK ETFs see consistent inflows, reaching $54.69 million.

- Chainlink price drops, but holds above $12, showing resilience.

Since November 2025, the top 100 largest wallets holding Chainlink (LINK) have aggressively accumulated tokens. These wallets, which control substantial portions of LINK, have added 20.46 million tokens, valued at approximately $263 million, by December 2025.

This accumulation trend started on November 1st, signaling a shift in the market sentiment of these “whales.” Their holdings rise in line with LINK’s price surge, suggesting confidence in its long-term growth. The wallets include centralized exchanges, whale accounts, and significant contracts with large balances.

The recent trend indicates a reversal of earlier positions taken by large holders, as they expand their LINK portfolios. As the price rises, the data reflects that major players are more optimistic about LINK’s future.

This accumulation coincides with a broader bullish sentiment, suggesting that institutional and high-net-worth investors are positioning themselves for further growth in LINK.

Chainlink ETFs Experience Strong Inflows Amid Short-Term Price Drop

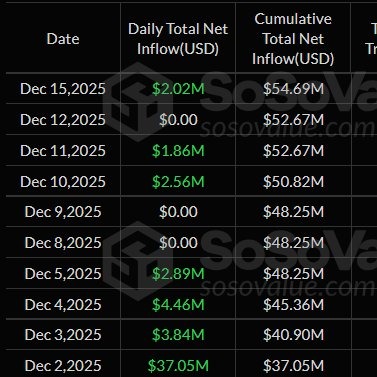

Moreover, Chainlink (LINK) exchange-traded funds (ETFs) have seen strong investor interest, with consistent net inflows. On December 15, 2025, LINK ETFs recorded a net inflow of $2.02 million, bringing the total to $54.69 million.

This follows a trend of inflows, with daily totals ranging from $0 to $37.05 million in early December 2025. The steady influx of capital into these ETFs suggests continued positive market sentiment toward Chainlink.

Despite the recent drop in LINK’s price, currently at $12.72, the market outlook remains uncertain. Over the past seven days, LINK has seen a 7.96% decline, reflecting broader market pressures.

However, its resilience above $12 suggests that it may hold steady despite the bearish trend. The technical chart indicates that LINK is testing key support levels, and any break above $16.0 could signal a potential rebound. Conversely, a retracement could push the price toward the $9.50 support.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |