- Market uncertainty due to allegations.

- Implications for blockchain network transparency.

- Potential for increased regulatory inquiries.

On December 17, former Theta Labs executives Jerry Kowal and Andrea Berry filed lawsuits in California, accusing CEO Mitch Liu of fraud and market manipulation.

The lawsuits highlight concerns within the crypto industry about transparency and ethics, although no immediate market impact on Theta’s cryptocurrency tokens is evident.

Market Uncertainty Surrounds Theta Amid Allegations

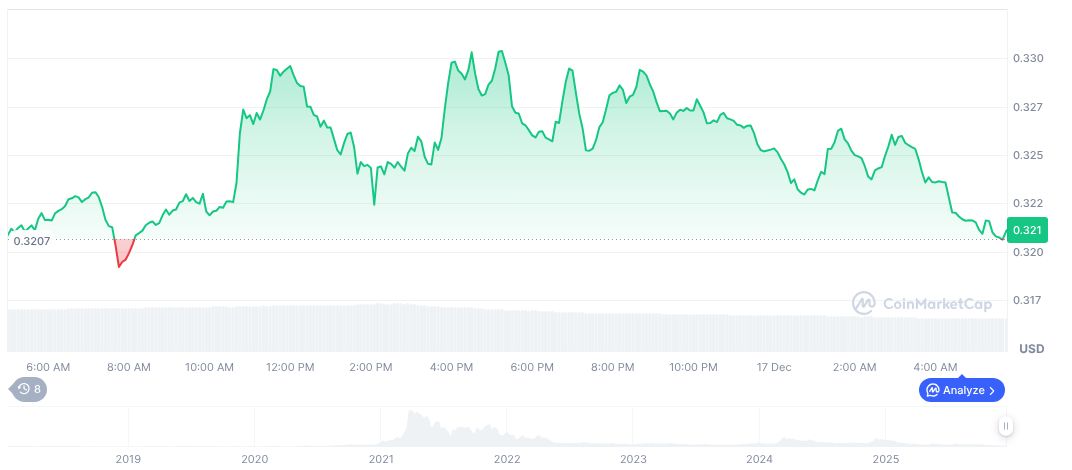

Theta Network (THETA) currently stands at a price of $0.32, showing a market cap of $320.86 million as per CoinMarketCap data. Despite the allegations, THETA’s 24-hour trading volume is down by 20.20%, and its price dropped 62.23% in 90 days, revealing broader market volatility.

The Coincu research team suggests these allegations could lead to increased scrutiny. They could also affect future partnerships or token performance. Insightful analysis indicates potential regulatory or compliance inquiries as indicators for the asset’s viability within the blockchain ecosystem.

Market Insights and Future Implications

Did you know? A recent report by Hagens Berman highlights ongoing legal actions against companies, reinforcing the importance of legitimate operational transparency within blockchain networks.

Theta’s market performance remains volatile, with significant fluctuations observed in recent months.

Experts suggest that the ongoing legal challenges could reshape the perception of Theta Labs and impact investor confidence in the cryptocurrency market.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |