Key Insights:

- Ethereum is showing a hidden bullish divergence after rejecting $4,811.71, suggesting potential upside.

- Only 8.8% of ETH remains on centralized exchanges, lowest level recorded in nine years.

- If ETH clears $4,800 resistance, technical charts suggest a breakout toward the $8,557.78 level.

Ethereum was trading at $2,856.49, following a 24-hour drop of 2.3% and a 7-day decline of 15.2%. The 24-hour trading volume stands at $24.1 billion, showing continued market interest despite recent price weakness.

The price action follows a recent move where Ethereum touched $4,811.71, a level that previously acted as a ceiling. Since then, price has retraced, which is often expected after testing such a known area. ETH now appears to be consolidating, as traders wait for the next move.

Chart Pattern Points to Possible Upward Move

On the chart, Ethereum has formed a higher low, while the RSI has made a lower low. This setup, known among traders as hidden bullish divergence, can suggest that the broader trend is still intact even after a pullback.

A similar pattern appeared in late 2022. At that time, the price later rose to the same $4,800 level. The current setup is showing the same structure, suggesting that ETH could revisit this area once again. The difference now is the overall market environment, which adds an extra layer of uncertainty.

ETH also remains above a long-term trendline that was broken earlier, signaling that the broader move from the lows of 2022 is still in play.

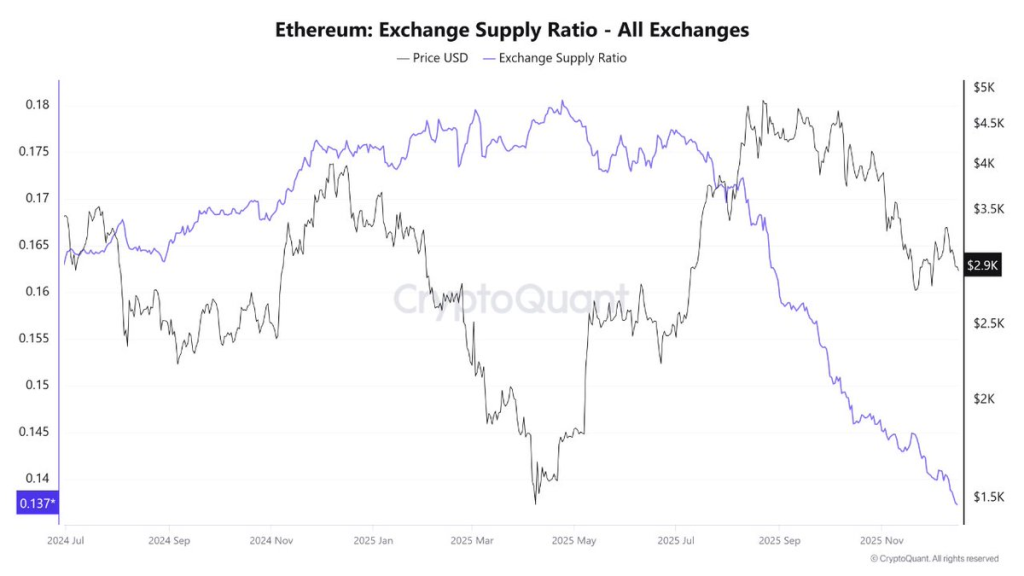

Exchange Supply Drops to 9-Year Low

The amount of Ethereum held on centralized exchanges has now dropped to just 8.8% of total supply. This is the lowest ratio seen in nearly a decade, based on blockchain data.

According to CryptoQuant, the Exchange Supply Ratio is now at 0.137, reflecting a steady decline throughout 2025. A lower ratio means fewer coins are sitting on exchanges, often a sign that holders are choosing to store their ETH in wallets or staking contracts rather than keeping them available for sale.

𝐊𝐚𝐦𝐫𝐚𝐧 𝐀𝐬𝐠𝐡𝐚𝐫 noted,

“This is the lowest ETH has been on exchanges in nine years,” adding that “it shows strong holding behavior, but demand still needs to support it.”

Break Above $4,800 Could Trigger $8.5K Target

If Ethereum moves back above the $4,811 level, chart analysis points to a possible next target of $8,557.78. This would represent a near 180% increase from current prices.

This target is based on previous price expansions and technical structures that tend to repeat in trending markets.

One analyst commented,

“Price needs to break and stay above $4,800 to confirm strength. Without that, the $8.5K level remains out of reach.”

Market attention was focused on whether ETH can build enough momentum to retest and break this key level in the coming months.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.