- JPMorgan projects stablecoin market to grow.

- Supply could expand to $750 billion by 2028.

- Growth is driven by crypto trading and derivatives.

JPMorgan Chase predicts the stablecoin market will reach between $500 billion and $600 billion by 2028, significantly below some forecasts, primarily driven by cryptocurrency trading and derivatives needs.

This projection highlights stablecoins’ growing role in trading over payments, signaling potential shifts in market strategy and stability, crucial for investors and financial institutions.

JPMorgan Forecasts $750 Billion Stablecoin Market by 2028

JPMorgan Chase has forecasted that the stablecoin market will reach around $500 billion to $750 billion by 2028, contrary to some expectations of higher numbers reaching trillions. Teresa Ho, Head of U.S. Short Duration Strategy at J.P. Morgan, provided insights on these projections, highlighting Tether (USDT) and Circle’s USDC as major contributors.

“There are reports out there that say stablecoins could grow to $2 trillion by the end of 2028, which we believe is a little bit optimistic. A more realistic scenario is that the market could grow two to three times from where we are right now in the next couple of years, which is equivalent to $500 to $750 billion.” — Teresa Ho, Head of U.S. Short Duration Strategy, J.P. Morgan.

The primary growth drivers are cryptocurrency trading and derivatives applications. Despite estimates suggesting potential $2 trillion to $4 trillion growth, stablecoin expansion remains focused on these sectors rather than broad payment systems. Current demand also significantly serves collateral needs in DeFi.

Community responses have been modest, with no notable direct reactions from influential crypto figures on social platforms about this specific projection. JPMorgan comments emphasize the evolving landscape of tokenized deposits and CBDC initiatives, potentially limiting stablecoin circulation expansion. These responses inform primary stakeholder perspectives in an industry adapting to align with evolving financial regulations.

Stablecoin Growth: Trade and Derivatives Outpace Payment Use

Did you know? The stablecoin market has achieved a growth rate comparable to doubling every year since 2020, although forecasts suggest that this may not sustain in the coming years.

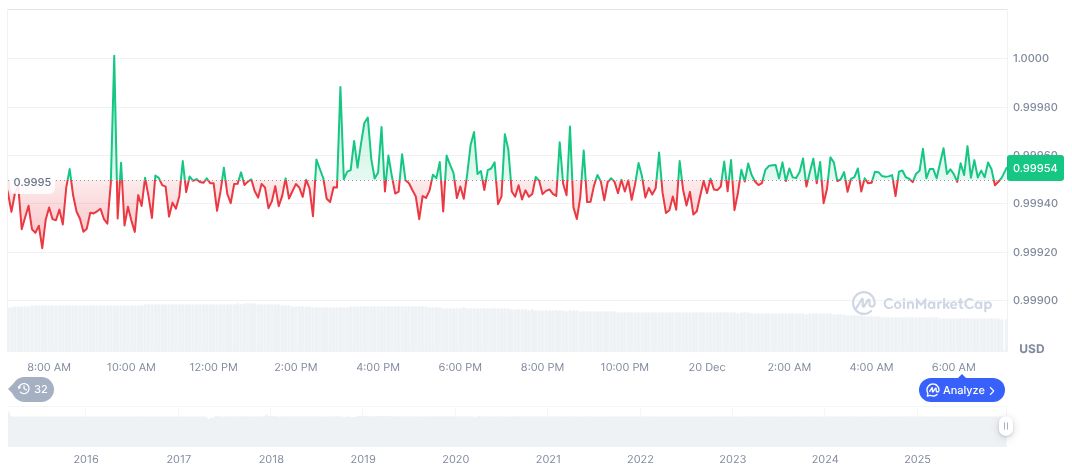

Data from CoinMarketCap shows Tether USDt (USDT) maintains its value at $1.00, with a market cap of $186.22 billion. Its daily trading volume fell approximately 27.83%, marking a notable fluctuation. Price changes remain minimal, with current figures documenting -0.07% over 7 days and 0.02% over 30 days.

Insights from Coincu suggest stablecoin velocity could enhance with broader market integration, decreasing reliance on supply increase alone. Tokenization in banking sectors indicates alternative financial routes aligned with regulatory advancements. Historical trends underline the importance of regulatory frameworks in dictating stablecoin pathways as seen following past incidents such as the TerraUSD collapse.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |