Strategy Faces Possible MSCI Index Exclusion Over Crypto Holdings

- Potential removal of Strategy from MSCI impacts $9 billion stock demand.

- MSCI proposes excluding firms with high digital asset holdings.

- Companies argue the exclusion discriminates against the crypto sector.

Strategy, known for its Bitcoin holdings, may face exclusion from MSCI indices, impacting up to $9 billion in stock demand, as MSCI evaluates digital asset-focused companies.

This prospective change raises concerns about the crypto industry’s stability and highlights sector-specific investment risks, potentially prompting broader financial market repercussions.

MSCI’s Crypto Exclusion Sparks $8.8 Billion Demand Risk

MSCI proposed excluding companies with more than 50% digital assets from its indices, regarding them as more similar to investment funds. This action primarily targets Strategy, whose Bitcoin strategy represents 74.5% of the affected market cap. MSCI aims to finalize its decision by January 15, 2026. If the removal occurs, Strategy may face notable demand impacts with the potential loss of $8.8 billion due to reduced attractiveness by exclusion from indices like Nasdaq 100 and others. This could force companies to reevaluate their asset allocations.

BitcoinForCorporations, linked to Michael Saylor’s network, has criticized MSCI’s proposal as discriminatory, suggesting enhanced disclosure rather than exclusion. The group argues these companies are engaged in genuine operational activities rather than mere asset holding. As stated by BitcoinForCorporations, “MSCI’s approach is discriminatory toward crypto treasuries, as it does not exclude companies holding gold or bonds, and we recommend enhanced disclosure instead of exclusion.” Many firms, inspired by Strategy’s past actions, worry about the sustainability of maintaining crypto assets on their balance sheets.

Coincu’s research team highlights potential shifts in financial strategies among affected companies, emphasizing regulatory scrutiny over digital asset treasuries. Suggestions include diversifying asset holdings to reduce regulatory risks and maintaining compliance with evolving standards. This aligns with historic trends when firms adapted rapidly to external economic pressures.

Bitcoin Market Volatility and Strategic Adjustments

Did you know? The 2025 tariff threat on Chinese imports, much like MSCI’s crypto index review, previously led to a $19.16 billion crypto liquidation; BTC dropped from $125,000 to $101,500 due to forced selling.

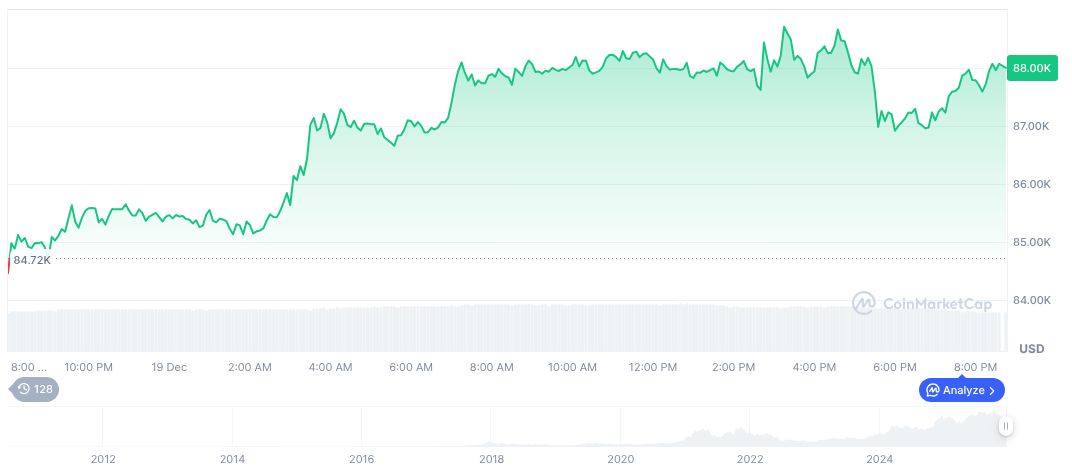

According to CoinMarketCap, Bitcoin (BTC) trades at $88,154.74 with a market cap of $1,759,981,354,839.00. The 24-hour trading volume stands at $33,210,137,896.00, signaling a contraction of 43.83% compared to previous volumes. Recent performance sees BTC maintaining a slight 0.20% rise in the last 24 hours while experiencing a 23.87% decline over a 90-day span as of 12:43 UTC on December 20, 2025.

Coincu’s research team highlights potential shifts in financial strategies among affected companies, emphasizing regulatory scrutiny over digital asset treasuries. Suggestions include diversifying asset holdings to reduce regulatory risks and maintaining compliance with evolving standards. This aligns with historic trends when firms adapted rapidly to external economic pressures.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |