Fundstrat’s Sean Farrell Addresses Bitcoin Market Outlook Discrepancies

- Sean Farrell discusses Bitcoin’s market outlook and potential 2026 risks.

- Long-term bullish sentiment despite short-term pressures.

- Bitcoin expected to reach new highs this year.

Sean Farrell and Tom Lee of Fundstrat address divergent market views on Bitcoin, amid major economic risks and portfolio strategy discussions on the X platform.

Differing approaches underscore varied investor needs, with Farrell targeting high crypto allocations and Lee focusing on institutional strategies during anticipated market shifts.

Bitcoin’s Performance Amid Market Cycles and Institutional Interest

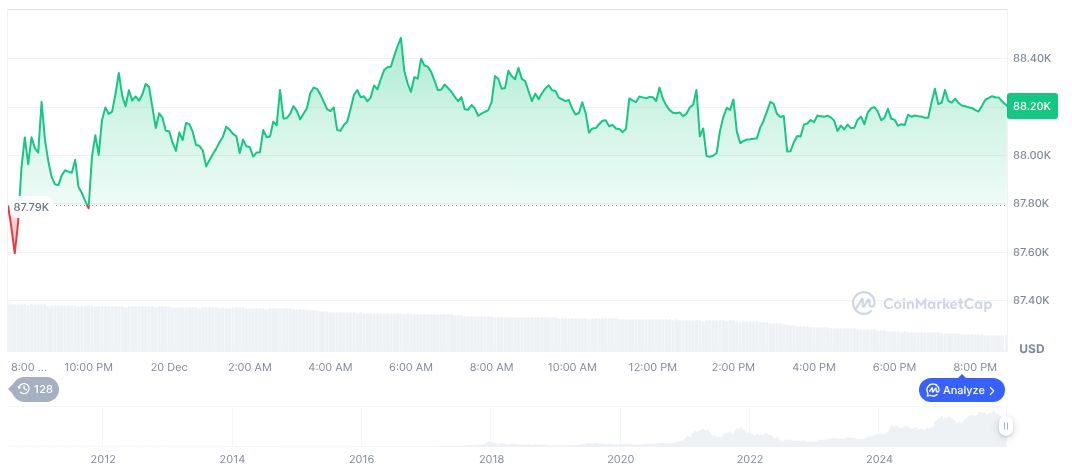

As of December 21, 2025, Bitcoin (BTC) price is $88,746.29, with a market cap of $1.77 trillion, and market dominance at 59.03%, according to CoinMarketCap data. Over the past 30 days, Bitcoin prices increased by 7.61% but decreased by 21.12% over 90 days.

Insights from Coincu Research Team suggest institutional interest in ETFs could boost long-term market support. Technological advancements and clearer regulatory guidance are anticipated to reduce current market uncertainties.

While I believe Bitcoin and the overall crypto market still have strong long-term upside potential, and liquidity-driven support is expected in 2026, there may still be some risks to digest in the first/second quarter of 2026. – Sean Farrell, Head of Digital Assets Strategy at Fundstrat, Fundstrat 2026 Crypto Outlook

Bitcoin’s Performance Amid Market Cycles and Institutional Interest

Did you know? Bitcoin is following its traditional four-year cycle, with expectations for new highs despite potential pullbacks, continuing a historical trend observed in previous market cycles.

As of December 21, 2025, Bitcoin (BTC) price is $88,746.29, with a market cap of $1.77 trillion, and market dominance at 59.03%, according to CoinMarketCap data. Over the past 30 days, Bitcoin prices increased by 7.61% but decreased by 21.12% over 90 days.

Insights from Coincu Research Team suggest institutional interest in ETFs could boost long-term market support. Technological advancements and clearer regulatory guidance are anticipated to reduce current market uncertainties.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |