Key Insights:

- ETH faces resistance above $3,060, forming a head and shoulders pattern with downside risk.

- Daily chart shows lower highs; $2,700–$2,800 support could attract buyers if weakness continues.

- Weekly support between $2,100–$2,350 remains crucial to maintain Ethereum’s broader long-term structure.

Ethereum remains under pressure after the price failed to hold above the $3,060 area. ETH was trading near $2,958, posting a daily loss of more than 3%, while weekly performance remains mostly unchanged. Trading volume stays elevated, showing steady market activity during this phase.

Price action shows repeated rejection above the $3,000 mark. Sellers continue to defend the $3,020–$3,100 zone, which previously acted as support. Since losing that level, Ethereum has struggled to regain upward momentum, keeping price capped below key resistance.

Pattern Formation Adds Short-Term Downside Risk

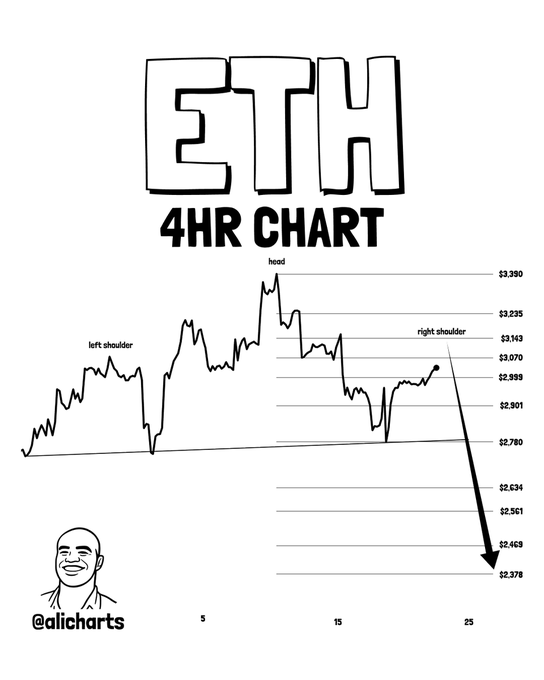

On the 4-hour chart, Ethereum is forming a head and shoulders pattern.

Ali Charts stated,

“Ethereum $ETH appears to be forming a head and shoulders pattern, pointing to a potential move toward $2,400.”

The structure shows a left shoulder near $3,230, a head close to $3,390, and a right shoulder below $3,100.

ETH was trading near neckline support between $2,950 and $2,900. A firm break below this area would confirm the pattern and keep selling pressure active. Attempts to recover above $3,070–$3,100 have failed so far, leaving downside levels in focus.

$2,700–$2,800 Zone Draws Attention on Daily Chart

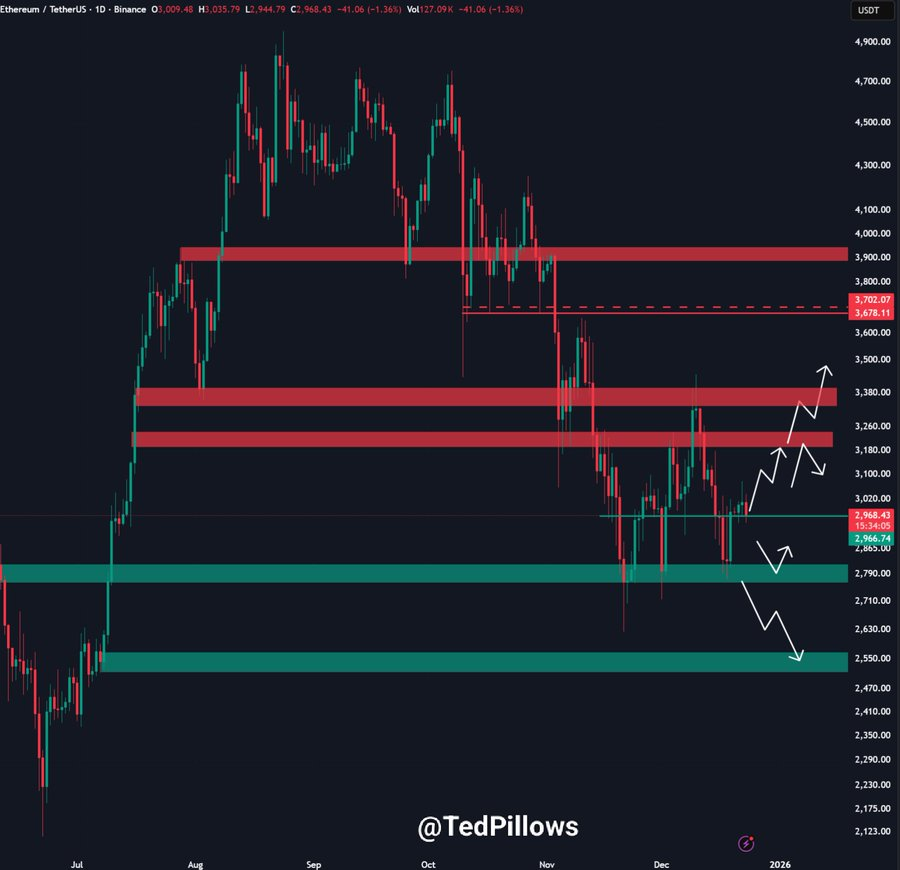

Daily price action shows Ethereum failing to reclaim the $3,000 level.

Ted Pillows commented,

“If Ethereum doesn’t reclaim this zone soon, it could drop towards the $2,700–$2,800 support zone.”

However, this range previously acted as a strong demand area and may attract buyers again if price continues lower.

ETH was forming lower highs on the daily timeframe, showing limited buyer strength. Several resistance zones remain overhead, and price needs a daily close above $3,000 to reduce short-term downside pressure.

Weekly Support Still Holds the Broader Structure

On the weekly chart, Ethereum continues to move sideways after its rejection near $4,800. Kamran Asghar noted that “the $2,100–$2,350 zone is the must-hold macro support to keep the long-term trend intact.” This range has acted as a key price floor in past market phases.

As long as Ethereum stays above this support on weekly closes, the broader structure remains stable. A move below $2,100 would signal further weakness, while holding above this zone keeps ETH in a wide consolidation range rather than a sustained decline.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |