- Circle refutes reports of launching USDC tokenized precious metals swaps.

- No official confirmation of the alleged Circle Metals subsidiary.

- Market remains unaffected with no primary source backing the claim.

Circle reportedly launched a new service through its subsidiary, Circle Metals, allowing USDC swaps for tokenized gold and silver, aiming to enhance stability and transparency in blockchain finance.

The initiative promises to integrate precious metals with blockchain, yet lacks official confirmation, indicating potential industry skepticism and unresolved market impacts.

USDC Stability Amid Rumors and Expert Insights

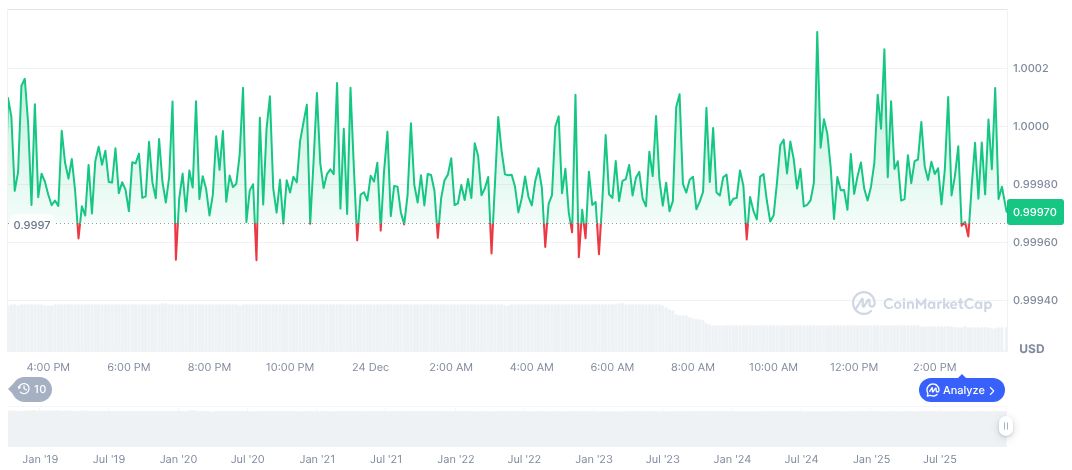

According to CoinMarketCap, USDC has a stable price at $1.00, maintaining a market cap of $76.66 billion with a dominance of 2.61%. Its 24-hour trading volume stands at $9.77 billion, recording a 48.39% decline. Recent price movements showed minor fluctuations, including a 1.43% rise over 24 hours but a 1.27% drop over 90 days.

The Coincu research team suggests the lack of tangible progress or new technologies in USDC’s operational strategy strengthens the notion that Circle remains committed to existing endeavors rather than exploring unverified initiatives. Analysts emphasize the criticality of relying on verified announcements for informed decision-making in cryptocurrency markets.

“It appears that there are no confirmed quotes or statements from key players, leadership, or experts regarding the launch of Circle Metals, or USDC-based swaps for tokenized gold (GLDC) and silver (SILC), as all searches return unconfirmed or speculative results.”

Market Overview

Did you know? The use of blockchain technology for commodity trading is still in its infancy, with many companies exploring its potential to enhance transparency and efficiency.

USDC’s market performance indicates a stable trading environment, despite the ongoing rumors surrounding its new initiatives.

Experts suggest that the current market dynamics require a cautious approach, as speculative reports can significantly influence investor sentiment and market stability.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |