- Morgan Stanley predicts “jobless productivity boom” with inflation effects.

- A potential shift in Federal Reserve’s rate cut strategy.

- Investors anticipate a 72% likelihood of rate changes.

Morgan Stanley’s recent analysis indicates a potential ‘jobless productivity boom’ in the U.S., leading to anticipated Federal Reserve rate cuts, with implications for the economy’s inflation dynamics.

The forecast highlights potential shifts in monetary policy and investor sentiment amid enhanced productivity, driven by AI advancements, which could influence broader economic trends and financial strategies.

Fed Rate Predictions Clash with Investor Sentiments

The anticipated rate cuts by the Federal Reserve next year contrast with its official stance of one rate reduction by 2026. This outlook contrasts with investors’ expectations, highlighting differing perspectives on monetary policy adjustments.

While officials predict only one rate cut by 2026, investors speculate a 72% chance of a decrease by the year’s end. Market sentiment emphasizes skepticism over official forecasts. The CME FedWatch data highlights expectations for more aggressive cuts.

Did you know? The anticipated “jobless productivity boom” by Morgan Stanley echoes similar economic outlooks seen before major technological advancements, potentially heralding enhanced efficiency across sectors.

Market Insights and Bitcoin Performance

Did you know? The anticipated “jobless productivity boom” by Morgan Stanley echoes similar economic outlooks seen before major technological advancements, potentially heralding enhanced efficiency across sectors.

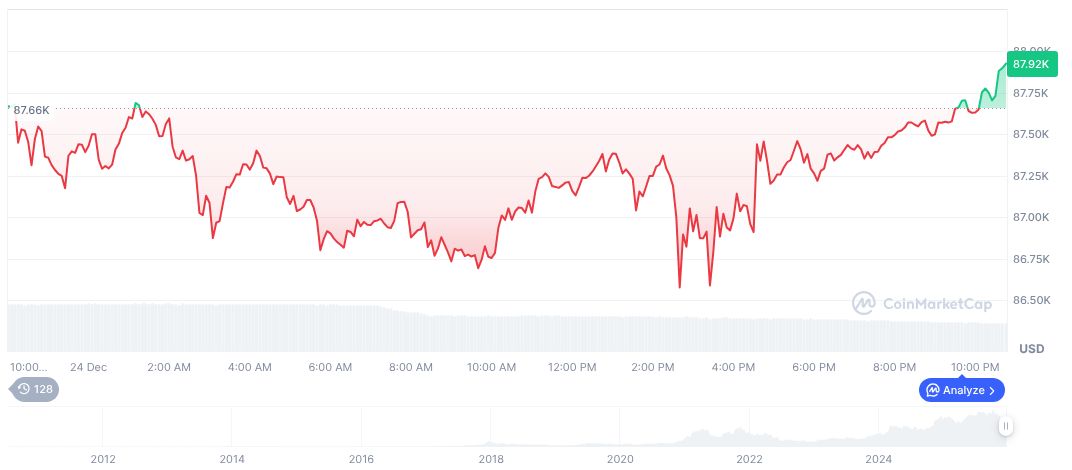

Bitcoin (BTC) currently trades at $87,418.71 with a market cap surpassing $1.74 trillion. Its 24-hour trading volume has decreased by 33.59%, standing at $21.72 billion. Per CoinMarketCap, BTC’s price exhibited fluctuations over recent months, including a 22.16% dip over 60 days.

The Coincu research team emphasizes historical data’s importance in understanding regulatory and financial trends. AI’s impact on productivity could reshape economic paradigms, urging policymakers to anticipate technological shifts in guiding future decisions.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |