Key Insights:

- Bitmine’s Ethereum holdings turned sharply negative after ETH dropped below $3,000 in late October.

- Ethereum faces strong resistance near $3,000 while $2,800 remains the key short-term support level.

- A weekly inverse pattern suggests recovery only if ETH breaks and holds above $3,344.

Recent on-chain data from CryptoQuant shows that Bitmine is holding an unrealized loss of around $3.5 billion on its Ethereum (ETH) holdings. The loss followed a steady decline in ETH’s price, which fell from over $4,000 in October to below $3,000 by late December.

Between July and October, Bitmine’s ETH position was in profit, with the market trading between $3,800 and $4,800. After October, the situation reversed. As the price dropped, Bitmine’s position turned negative. The red zone on the CryptoQuant chart shows a consistent loss since early November. There has been no indication of a major sell-off or portfolio adjustment so far.

Ethereum Struggles to Break $3,000

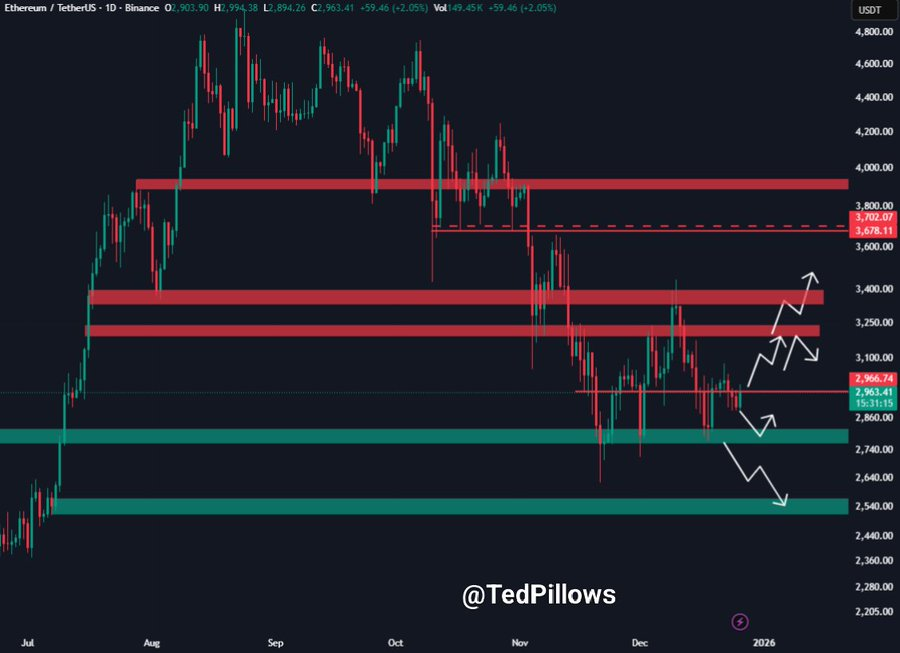

ETH recently attempted to move above the $3,000 level but was rejected. Market data shared by Ted shows that ETH remains stuck below a resistance area between $3,000 and $3,100. This zone has blocked upward moves in the past and continues to hold firm.

Ethereum was trading near $2,958. If it fails to break above $3,000, a retest of the $2,800 support area may follow. That support has held several times, but if it gives way, the price could drop toward the next area of interest between $2,540 and $2,600.

Weekly Chart Shows a Key Pattern Forming

A weekly ETH chart shared by Donald dean shows an inverse Head & Shoulders structure. This setup is often watched for signs of trend change. The key level to watch is $3,344. This price marks both the neckline of the pattern and a major trading zone from previous months.

ETH would need to close above $3,344 to confirm the structure. This level also aligns with a high-volume price area and the 0.618 Fibonacci level. If ETH moves above this line, the next target could be around $4,122.

Price Movement Remains in a Tight Range

ETH continues to trade within a defined range. The $3,000 level acts as resistance, while the $2,800 zone offers support. The market appears to be waiting for a clear breakout before setting a new direction.

Bitmine has not yet reduced its position, and it remains unclear whether it plans to hold or exit. “It’s unclear whether Bitmine plans to hold or exit this position,” as noted in the analysis. With ETH still under pressure, the coming days may be key in deciding the outcome of this large open position.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.