Liquidity Boost Stabilizes Solana-Based Stablecoin USX After Market Drop

- The USX stablecoin on Solana chain faced a significant drop due to liquidity issues.

- Solstice Finance injected liquidity, stabilizing USX’s price to $0.94.

- Underlying assets of USX remain unaffected with over 100% collateralization.

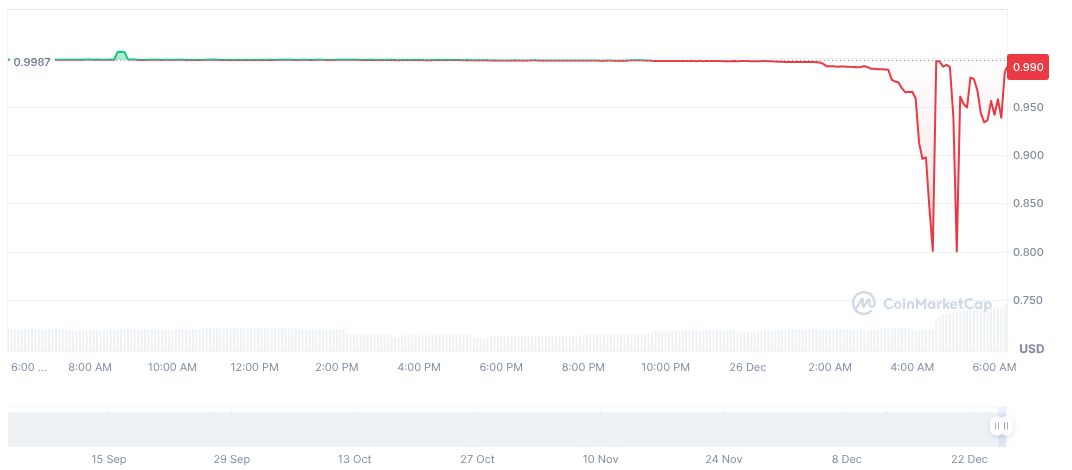

The Solana-based stablecoin USX experienced severe market fluctuations, decoupling from its peg on December 26, 2025, reportedly due to secondary market liquidity issues according to issuing firm Solstice Finance.

This instability in USX highlights vulnerabilities in secondary market liquidity, impacting its price and raising concerns over stablecoin stability despite injection efforts to restore normal market operations.

Solstice Finance’s Quick Intervention Amid USX Price Drop

USX on Solana faced a liquidity-induced price drop to $0.1, raising concerns among investors. Solstice Finance, the issuer of USX, quickly stepped in, emphasizing that the depletion was a secondary market issue. The firm collaborated with market makers to inject liquidity, and the price rebounded to $0.94.

The intervention demonstrated Solstice’s ability to manage market perturbations, highlighting the importance of robust liquidity mechanisms. Solstice confirmed that the core value of USX’s assets remained intact and collateralization was unaffected, underpinning the stablecoin’s financial stability.

Market reactions were mixed, as the incident echoed past stablecoin challenges. However, the prompt action by Solstice soothed some concerns. The team plans to release a third-party certification report for transparency, affirming that the primary market is unaffected.

Historical Lessons and USX’s Price Recovery Analysis

Did you know? In similar stablecoin incidents like USDC’s 2023 depeg, insolvency issues were involved. In contrast, USX maintained full collateralization, showing the critical role of liquidity management in cryptocurrency stability.

Based on CoinMarketCap data, Solstice USX is currently valued at $1.00, with a dramatic increase in its 24-hour trading volume by 544.64%, amounting to $30,615,258.78. Despite recent challenges, the primary exchange rates indicate a slight 0.82% rise over the past 24 hours, stabilizing the market.

Coincu’s research team points out that maintaining robust market mechanisms and transparency is essential for stablecoin trust. Solstice’s swift liquidity intervention serves as a model, potentially influencing future regulatory frameworks and investor expectations within the crypto sector.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |