- Temporary halt of FLOW deposits and withdrawals by Upbit.

- Significant security concerns prompt market caution.

- Potential for further restrictions if risks escalate.

Upbit, South Korea’s cryptocurrency exchange, suspended Flow (FLOW) transactions on December 27, citing security concerns on the FLOW mainnet, while DAXA issued a trading risk warning.

The suspension highlights Upbit’s proactive measures amidst mounting security concerns, reflecting market vigilance and potential impacts on FLOW trading activities.

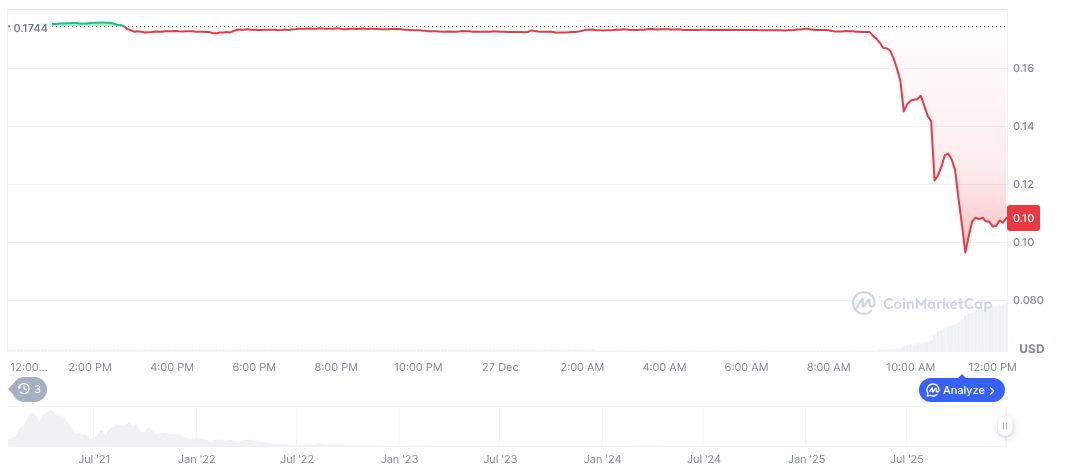

FLOW’s Market Plunge and Regulatory Implications

On December 27, 2025, Upbit, a South Korean cryptocurrency exchange, temporarily suspended FLOW deposits and withdrawals due to perceived security risks on the Flow mainnet. This move, aimed at protecting users, may lead to further trading restrictions.

Upbit suspended all FLOW activities as a proactive user protection measure following signs of a security issue on the Flow mainnet. While the exact timeline for resumption remains unknown, the Digital Asset Exchange Association (DAXA) has also issued a trading risk warning, indicating potential future actions such as trading suspension. Neither Flow’s official channels nor leadership have confirmed the incident, suggesting the possibility of an unverified rumor influencing the decision. Market observers say the move reflects growing caution among exchanges in addressing security threats. No comments from Flow’s leadership or institutions have surfaced regarding the incident, leading to speculative interpretations.

Did you know? Cryptocurrency exchange security breaches have led to considerable market volatility, with significant past incidents often catalyzing stricter regulations.

Market Data and Future Insights

Did you know? Cryptocurrency exchange security breaches have led to considerable market volatility, with significant past incidents often catalyzing stricter regulations.

According to CoinMarketCap, Flow’s current price is $0.11, with a 24-hour trading volume of $172,676,223, representing an 1801.05% increase. FLOW’s market cap stands at $173.21 million, reflecting its market dominance at 0.01%. Recent price movements indicate a 39.39% drop over 24 hours, underscoring historical volatility concerns.

The Coincu research team anticipates heightened regulatory scrutiny on digital exchanges following such incidents, which can result in tighter security standards. Historical data highlights the importance of robust infrastructure in maintaining market confidence amidst evolving threats.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |