AAVE Surges Past Bullish Flag Pattern, Setting Sights on the $130 Price Mark

Key Insights:

- AAVE price breaks bullish flag pattern, eyeing $130 resistance level.

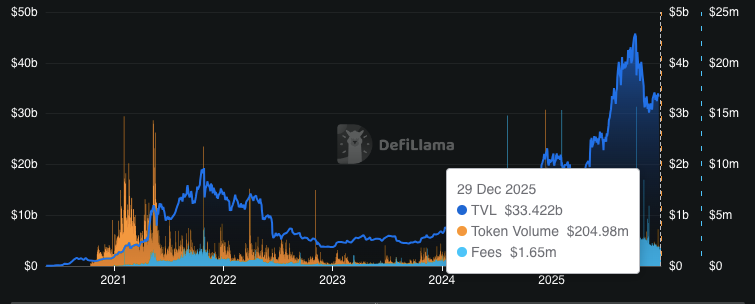

- DeFi sector growth boosts AAVE’s price potential, reaching $33.4B TVL.

- Technical indicators show mixed signals, with traders monitoring support at $150.

AAVE has shown strong momentum recently, breaking out of a bullish flag pattern. As of press time, AAVE is priced at $150.56, reflecting a 1.23% decline over the past 24 hours. Traders are awaiting a potential bounce or further downside.

AAVE Price Movement and Technical Indicators

AAVE has recently shown signs of a strong price movement, breaking past a bullish flag pattern. According to Ali_charts, the breakout signals the potential for further gains, with the next key resistance point being $130.

As of December 29, 2025, AAVE is testing a critical support level at $150, with its price hovering just above this mark. However, the technical indicators paint mixed signals.

The MACD shows bearish momentum with a widening gap between the signal and MACD lines. This suggests a possibility of more downside before the price moves upward. The surge in asset`s price follows a broader rally within the decentralized finance (DeFi) sector

DeFi Sector Growth Fueling AAVE’s Surge

Meanwhile, the DeFi sector has seen a notable rise in recent months. As of today, the total value locked in DeFi platforms stands at $33.4 billion, a significant jump from previous years.

This surge is also reflected in the increasing token volume, which has reached $204.98 million, along with $1.65 billion in fees generated by DeFi platforms. The growth in DeFi has provided a favorable environment for AAVE and other DeFi tokens.

The sharp rise in TVL and token volume indicates a growing interest in decentralized finance, potentially adding more strength to AAVE’s price trajectory. AAVE’s recent breakout aligns with this overall trend in DeFi, and analysts are now watching for further price movements in the coming days.

Traders Monitor AAVE’s Critical Support Levels

In addition, with the price showing signs of weakening, traders are closely watching for a potential breakout or a further decline. The price action over the next few days will provide insights into the direction of AAVE’s next move. The current price action, along with technical analysis, suggests that AAVE’s next target could maintain bullish momentum.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |