BitMine’s Ethereum Strategy Attracts South Korean Investors in 2025

- BitMine backed by Peter Thiel ranks second among South Korean investors.

- South Korean investors invested $1.4 billion in BitMine in 2025.

- Strategist Tom Lee on ETH market activity’s impact on BitMine’s strategy.

Despite an over 80% drop from its July peak, BitMine remains a preferred foreign stock among South Korean investors in 2025, second only to Alphabet.

BitMine’s continued popularity highlights enduring investor confidence in its Ethereum strategy, underpinned by leadership from Tom Lee and backing from billionaire Peter Thiel.

BitMine’s Aggressive Ethereum Acquisition Strategy in 2025

BitMine, known for significant Ethereum acquisitions, has sustained its position as a preferred investment among South Korean investors in 2025, only trailing behind Alphabet. The strategic direction under Tom Lee involves aggressive accumulation of Ethereum, aligning with the company’s ethos to control a substantial portion of ETH supply.

December saw consistent Ethereum purchases, adding 44,463 ETH in the last week alone. BitMine’s ambitious outlook remains unchanged, with $13.2 billion in crypto and cash assets enhancing its investing potential, despite an 80% drop from its peak valuation earlier this year.

“Market activity tends to slow as we enter the final holiday weeks of a calendar year. Bitmine added 44,463 ETH in the past week, as we continue to be the largest ‘fresh money’ buyer of ETH in the World.” — Thomas “Tom” Lee, Chairman of BitMine Immersion Technologies, Inc.

Market reactions indicate confidence in Tom Lee’s leadership, despite a reported technical downturn. South Korean investors’ $1.4 billion investment demonstrates belief in BitMine’s long-term potential, buffered by substantial backing from high-profile institutional investors like ARK and Founders Fund.

Current Ethereum Market Conditions and BitMine’s Influence

Did you know? A single firm like BitMine holding over 3% of Ethereum’s total supply is unprecedented in the market. This strategy stands as one of the boldest accumulative efforts outside institutional behemoths like Strategy Inc.

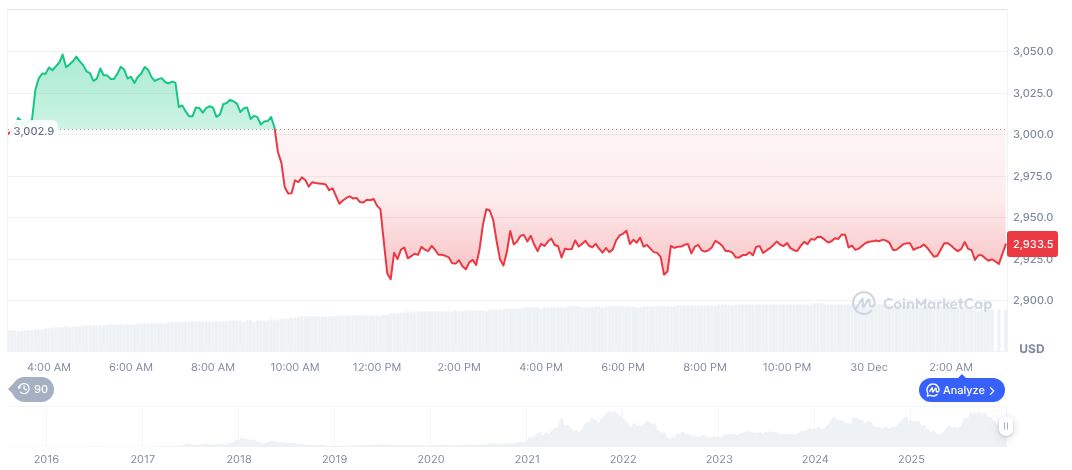

Ethereum (ETH) current price is $2,975.58, with a market cap of $359.14 billion, as reported by CoinMarketCap. Over 24 hours, ETH gained 1.70%, despite broader declines over the past 90 days. Trading volume reaches $18.85 billion, underscoring its active market presence.

Insights from Coincu’s research team suggest that BitMine’s focused Ethereum accumulation paints a bullish industrial sentiment. This strategic hoarding of ETH might drive technological innovation and regulatory scrutiny, indicating an impactful shift in market dynamics.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |