- Yield-bearing stablecoins distribute over $250 million in rewards in 2025.

- sUSDe leads with a 24.9% contribution.

- BlackRock’s BUIDL and sUSDS follow at 9.7% and 14.2%, respectively.

Sentora reported that yield-bearing stablecoins distributed over $250 million in rewards in 2025, with sUSDe, BlackRock’s BUIDL, and sUSDS contributing substantially.

This extensive payout underscores growing profitability in yield-bearing assets, signaling increased investor interest and participation in stablecoin markets within decentralized finance sectors.

Stablecoins Generate $250 Million in Rewards by 2025

Yield-bearing stablecoins, including sUSDe, BlackRock’s BUIDL, and sUSDS, distributed over $250 million in rewards by 2025. Supporting data confirms significant contributions.

This report highlights the increasing utility of stablecoins in generating consistent financial rewards. Changes observed in this sector reflect the broader potential impact on DeFi’s structure and market attractiveness.

Reactions from the industry appear limited, with no significant statements from leadership or institutional figures noted. The stablecoins’ performance aligns with ongoing trends in decentralized finance, drawing minor community attention.

Experts Anticipate Further Growth in Stablecoin Adoption

Did you know? Yield-bearing stablecoins like sUSDe have reached notable figures, coinciding with overall rewards exceeding $250 million in 2025, marking an evolving journey in digital finance since their broader availability.

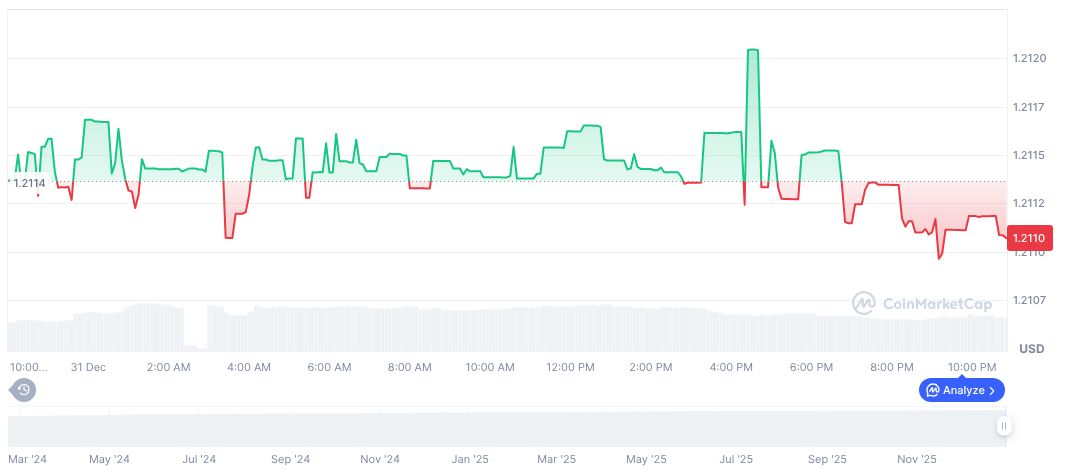

According to CoinMarketCap, Ethena Staked USDe (sUSDe) currently trades at $1.21, with a market cap of $3.47 billion. Its trading volume in the past 24 hours was approximately $7.97 million, showing a slight decline in activity. Recent price changes remain minimal, with a 90-day increase of 0.99% indicating relative stability.

The Coincu research team suggests that the recent growth in stablecoin rewards reflects ongoing market interest and potential for further integration with traditional financial systems. This aligns with historical trends of increasing adoption and financial innovation within the sector.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |