Key Insights:

- Bullish MACD crossover may signal early momentum shift as ETH tests major resistance levels.

- Over $2.6B in leverage could trigger liquidations if ETH makes a sharp directional move.

- US spot demand remains weak; negative Coinbase premium may delay Ethereum breakout follow-through.

Ethereum has formed a bullish MACD crossover on the 3-day chart. Similar patterns have appeared before strong price rises in the past. This signal comes after a long period of downward pressure and could point to a possible shift in trend.

At the time of writing, ETH was trading near $3,094. The MACD crossover happened below the zero line, which often points to a change in direction when market momentum starts to turn. Traders are watching to see if the price can push higher from this level.

Key Resistance Levels in Focus

The next major resistance for ETH is around $4,811.71. This level acted as a peak in a previous rally and could be a key test for buyers. If the price breaks and holds above it, the chart points to a next possible target of $8,557.68.

In earlier cases, MACD crossovers led to strong continuation moves once price cleared resistance. The current setup looks similar, but confirmation is still needed before momentum builds further.

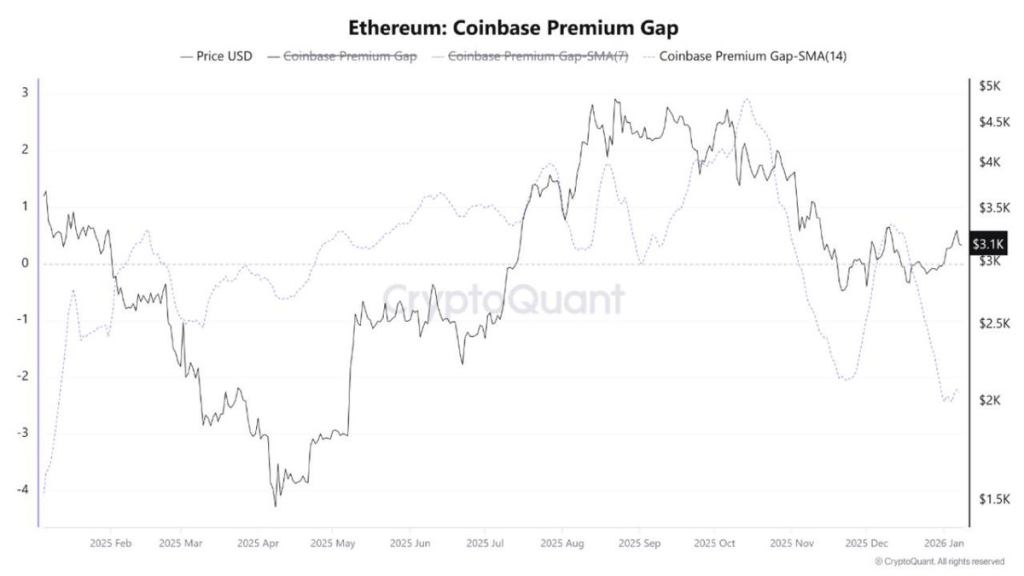

US Spot Demand Remains Low

Recent data shows Ethereum is trading at a lower price on US exchanges like Coinbase compared to global platforms. This is known as a negative premium and signals weaker demand from US buyers.

The Coinbase Premium Gap has remained negative for most of the past year. CryptoBusy posted,

“Until that premium flips positive, $ETH breakouts are more likely to stall than follow through.”

For Ethereum to hold gains, spot demand may need to improve, especially from US markets.

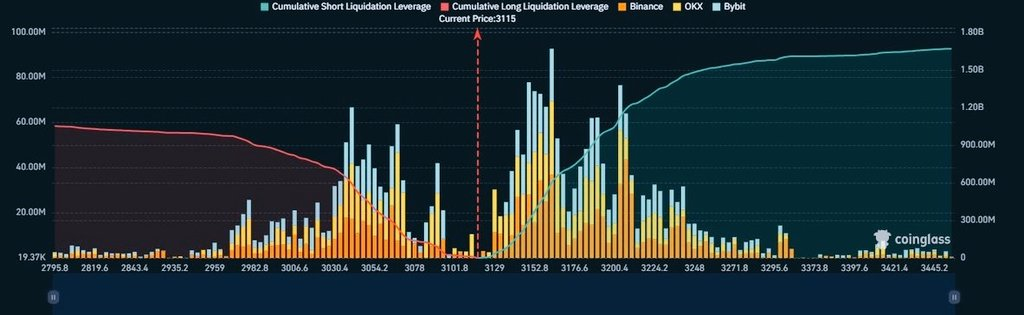

High Leverage Builds Up Across Market

There is now over $2.6 billion in open leveraged positions on both sides of the market. Around $1.6 billion in short positions could face liquidation if price rises 10%. On the other side, a similar drop could wipe out $1 billion in longs.

Coinglass data shows a large number of leveraged trades clustered between $2,800 and $3,400. A post from Jön Traderlar warned:

“As soon as a direction emerges, we could witness a very sharp liquidity cleanup.”

However,the chart suggests that any sharp move, up or down, may cause a wave of liquidations.

ETH Price and Volume Update

Ethereum’s price is down 0.91% in the past 24 hours and 0.79% over the last 7 days. Trading volume for the day is around $19.17 billion.

While the chart setup is showing early signs of strength, market demand and high leverage continue to play a major role. If ETH can stay above key levels and attract stronger interest, the move toward $8,557.68 could come into view.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.