- US advocacy group pushes for DeFi exclusion in legislation.

- Campaign pressures senators before crucial markup session.

- Reactions highlight transparency concerns and banking risks.

On January 10th, anti-DeFi group “Investors For Transparency” launched a Fox News ad urging viewers to pressure US senators against including DeFi provisions in cryptocurrency legislation.

This campaign underscores banking industry concerns about potential deposit shifts to DeFi, with the US Treasury estimating a possible $6.6 trillion impact.

Advocacy Efforts and Potential Market Shifts

Investors For Transparency launched an ad campaign urging viewers to contact their senators and push for legislation that excludes DeFi provisions. The ad claims that DeFi could hinder innovation, echoing concerns about potential market shifts.

If DeFi language is excluded, there could be substantial regulatory shifts affecting the $120 billion DeFi market. Immediate implications may include adjustments to user access and centralized integrations, particularly impacting US-based DeFi participants.

Responses from DeFi leaders include criticism from Uniswap Labs CEO Hayden Adams, who labeled the group’s lack of transparency as ironic. Other public figures, including Keith A. Grossman, emphasized the funding anonymity criticism on X.

Regulatory Changes: Impact on DeFi and Market Data

Did you know? The CLARITY Act discussions bear similarity to past debates on the regulation of yield-bearing crypto products, echoing concerns voiced during SEC actions against services like BlockFi.

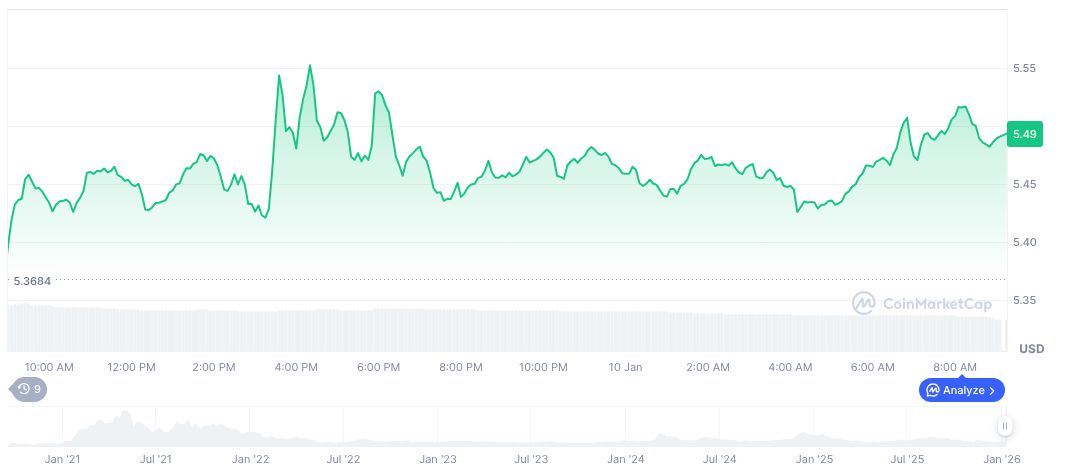

Uniswap (UNI) holds a market cap of $3.49 billion and a 24-hour trading volume of $240.27 million. Its price currently stands at $5.49, marking a 24-hour change of 1.12%. Recent declines include a 5.20% drop in seven days, reflecting market volatility (CoinMarketCap).

According to Coincu research, if the CLARITY Act excludes DeFi provisions, it may lead to potential financial reform, affecting market participation and liquidity. Regulatory shifts are likely to increase legal uncertainties in the DeFi space.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |