- Senate Banking Committee to review crypto market structure legislation.

- Scheduled for January 15, focusing on regulatory framework.

- No official data on manipulation or institutional inflows.

The U.S. Senate Banking Committee will convene on January 15 to discuss and potentially advance the Digital Asset Market Clarity Act, focusing on cryptocurrency market structure.

The act could define regulatory jurisdictions between the SEC and CFTC, impacting digital asset markets and institutional engagement.

Committee To Define SEC and CFTC’s Crypto Oversight

The Senate Banking Committee is preparing to evaluate the CLARITY Act during a January hearing. Key figures include Rep. French Hill, Sen. Tim Scott, and Sen. Cynthia Lummis. The act focuses on the regulatory framework to define SEC and CFTC roles.

The CLARITY Act aims to establish definitive oversight for digital commodities versus investment contracts, potentially curbing manipulation. It seeks to provide clear operating standards for market participants, though no official reduction percentages are confirmed.

Sen. Cynthia Lummis and Rep. French Hill have advocated for legislative clarity, describing the framework as necessary to foster innovation. Market experts await the Committee’s review to guide future business plans and ensure regulatory certainty.

“The CLARITY Act establishes clear, functional requirements for digital asset market participants, prioritizing consumer protection while fostering innovation. By providing strong safeguards and long-overdue regulatory certainty, the legislation advances American innovation and reinforces America’s leadership in the global financial system.” – Rep. French Hill (R-AR)

Bitcoin Faces Volatile Future Preceding January Hearing

Did you know? The CLARITY Act builds on historical attempts to delineate regulatory oversight, echoing initiatives like the GENIUS Act for stablecoins, which also aimed to resolve jurisdictional ambiguity in 2025.

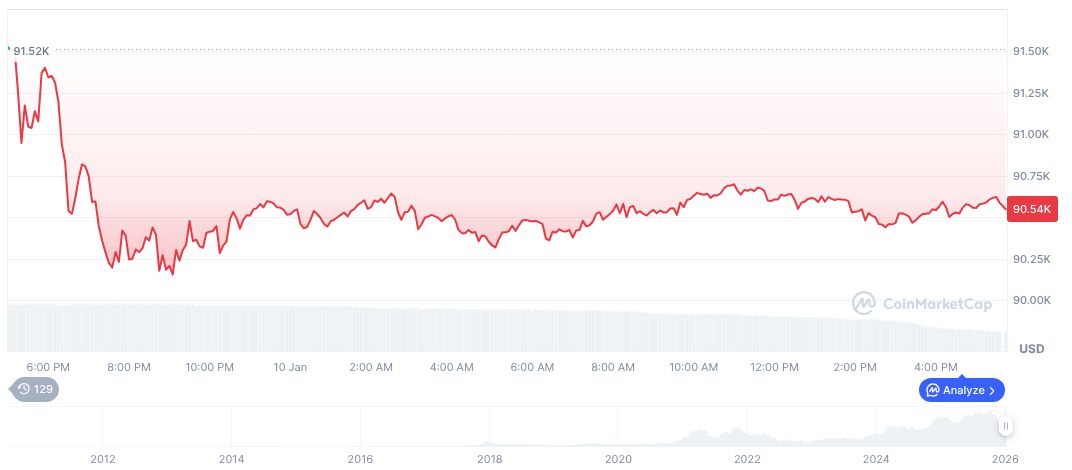

Bitcoin (BTC), at a recent price of $90,662.31, shows a market cap of $1.81 trillion with a 58.49% dominance, according to CoinMarketCap. Despite a 0.30% increase over 24 hours, it faces a 20.97% decline over 90 days. The trading volume plummeted by 66.62%.

Analysts from Coincu suggest that regulatory clarification through the CLARITY Act could stimulate market integrity and innovation, possibly attracting institutional participation. However, concrete impacts remain speculative pending legislative outcomes.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |