- The SEC approved U.S. Bitcoin spot ETFs on January 11, 2024.

- Bitcoin’s market exposure significantly increased.

- Institutional access to Bitcoin enhanced through ETFs.

Hal Finney’s iconic “Running bitcoin” tweet on January 11, 2009, coincides with the U.S. SEC’s approval of the first Bitcoin spot ETFs, marking a 15-year milestone.

This alignment emphasizes Bitcoin’s evolution from a niche concept to a mainstream financial asset, boosting institutional interest and potentially driving significant market liquidity and exposure.

Bitcoin Spot ETFs Launch Amid Institutional Interest Surge

The SEC’s approval of the first U.S. Bitcoin spot ETFs represents a historic milestone for digital asset markets. These ETFs, including Grayscale Bitcoin Trust’s conversion and BlackRock’s iShares Bitcoin Trust, began trading on major U.S. exchanges.

Institutional interest is expected to rise as spot Bitcoin ETFs provide regulated avenues for BTC investment. This change can impact market liquidity and pricing dynamics as funds increase their BTC accumulations.

“Spot #Bitcoin ETFs mark the beginning of a new era of Bitcoin adoption by institutional investors.” — Michael Saylor

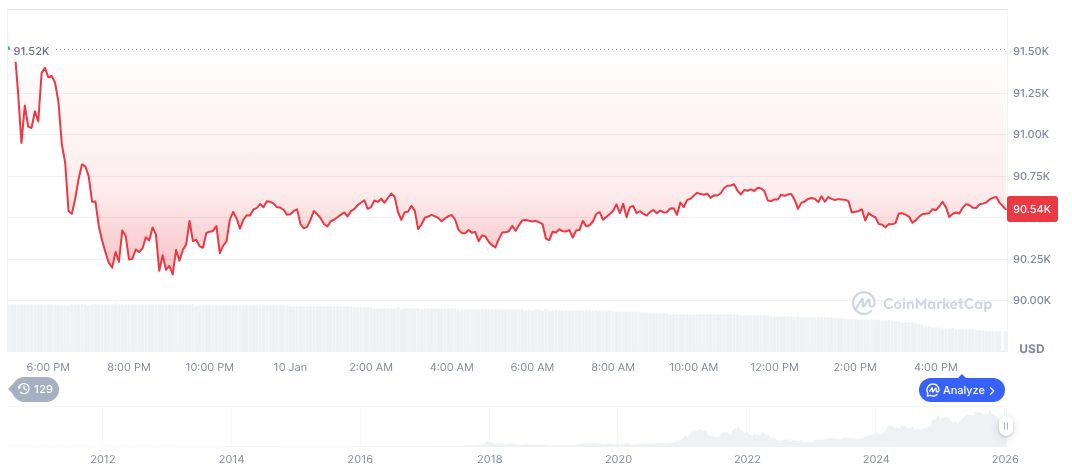

Bitcoin Reaches $90,673: Implications and Insights

Did you know? The U.S. Bitcoin spot ETF approval comes 15 years after Hal Finney’s “Running bitcoin” tweet, linking Bitcoin’s inception to its current institutional acceptance.

According to CoinMarketCap, as of January 11, 2026, Bitcoin’s price is $90,673.58, with a market cap of $1.81 trillion. Despite a recent 0.22% price gain, BTC showed a 21.02% decline over the past 90 days. Trading volume reached $11.96 billion, a 66.21% drop from previous activity levels.

Insights from the Coincu research team highlight the broader implications of Bitcoin spot ETFs. These financial instruments could bolster BTC liquidity while reinforcing trust through regulated investment vehicles. Future regulatory attitudes may shape further technological integration and market strategies.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |