Tether Usage in Venezuela’s Oil Trade Highlights Compliance Role

- Tether’s role in Venezuelan oil trade amid U.S. sanctions.

- Tether emphasizes sanctions compliance with U.S. authority.

- Venezuela uses USDT in oil scenarios to bypass sanctions.

Venezuelan President Nicolás Maduro leveraged Tether (USDT) to assist PdVSA in oil trades amid intensifying U.S. sanctions, as reported by the Wall Street Journal on January 11.

Tether’s role in circumventing sanctions highlights stablecoin reliance in restricted economies, while emphasizing cooperation with U.S. authorities for compliance.

Maduro’s USDT Transactions Challenge U.S. Sanctions

Nicolás Maduro utilized Tether to conduct oil transactions, reportedly circumventing U.S. financial sanctions through USDT settlements. This development has raised questions about digital currencies as potential tools for sanctions evasion.

Tether has reiterated its commitment to compliance, frequently coordinating with U.S. authorities, including the Department of Justice and the Office of Foreign Assets Control. The company works to freeze wallets involved in illicit activities upon official request.

Market analysts and regulatory bodies have expressed concern over the strategic use of USDT by sanctioned states. A Tether spokesperson confirms the firm’s engagement with U.S. authorities, emphasizing adherence to international financial compliance standards.

“We comply with all applicable U.S. and international sanctions regulations and cooperate with OFAC and law enforcement to freeze wallets when legitimately requested.” — Tether Spokesperson

Stablecoin Trends in Sanctioned Markets Prompt Regulatory Review

Did you know? By early 2024, numerous contracts by PdVSA started mandating USDT settlements, illustrating a broader trend of countries using stablecoins to bypass established financial blockades.

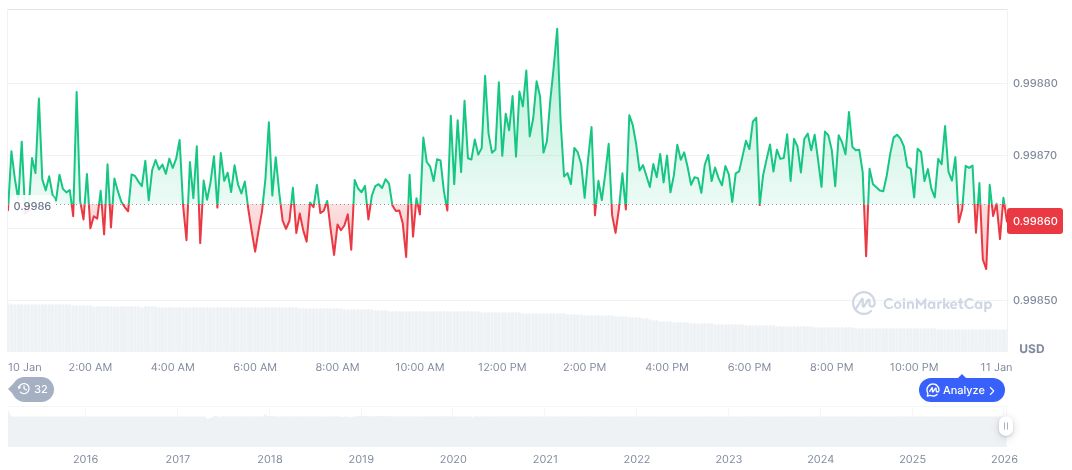

According to CoinMarketCap, Tether (USDT) maintains a current price of $0.99 with a market cap of $186.76 billion, representing 6.03% of the market. Recent 24-hour trading volume reached approximately $37.36 billion, marking a 43.54% decrease. Over the past 90 days, USDT’s price has dipped by 0.22%.

Insights from the Coincu research team suggest significant impacts if regulatory scrutiny intensifies on crypto used in sanctions circumvention. Expect various financial and technological adaptations to maintain compliance while accommodating legitimate trade transactions through digital currencies.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |