- Tether collaborates with U.S. authorities to combat sanctions evasion.

- Tether has frozen wallets connected to Venezuelan oil trades.

- USDT maintains price stability despite market volatility.

Tether’s USDT is central to Venezuelan oil trade sanctions evasion, involving Petróleos de Venezuela S.A. (PdVSA) and compliance with U.S. authorities, impacting global crypto markets.

This raises crucial questions about stablecoins’ roles in geopolitical financial strategies and U.S.-Venezuela relations, potentially affecting stablecoin regulations and enforcement practices.

Key Developments, Impact, and Reactions

“This move evokes a broader scrutiny,” highlighting the use of stablecoins in illicit finance, especially in regions under sanctions. PdVSA has reportedly relied on USDT for international payments, providing an alternative to traditional banking channels affected by sanctions.

Market reactions have been mixed, with some in the crypto community expressing concern over the precedents set by such enforcement actions. Tether’s spokesperson reiterated compliance with lines set by U.S authorities and its transparency in coordinating with law enforcement.

“Tether has participated in wallet-freezing campaigns aligned with U.S. sanctions priorities, including sanctions-evasion wallets.” — TRM Labs, Analyst, TRM Labs

Tether’s Actions Lead to Increased Scrutiny in Crypto

Did you know? Tether has frozen 41 wallets connected to Venezuelan sanctions since 2024, aligning with U.S. enforcement actions against such violations.

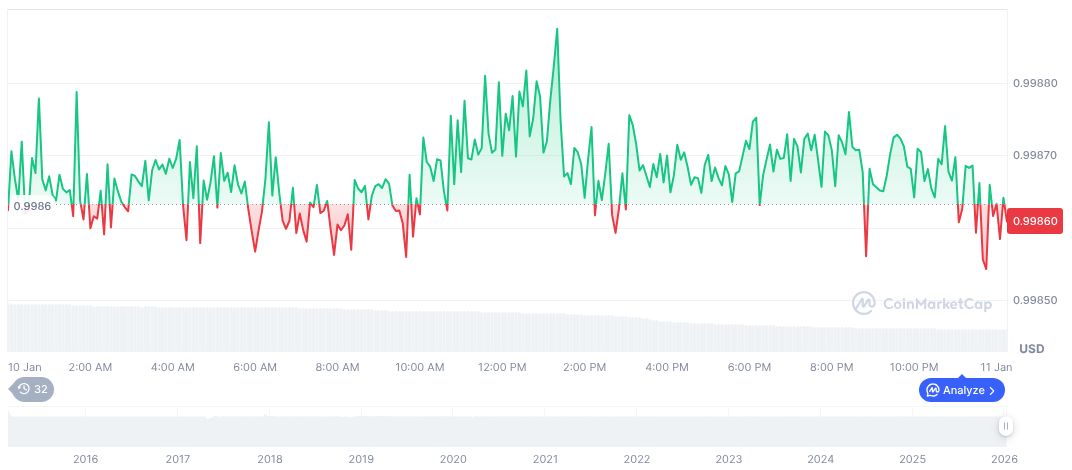

According to CoinMarketCap, Tether (USDT) remains pegged at $1.00, having a market cap of $186.72 billion and a dominance of 6.03%. Over the past 90 days, USDT’s price decreased by 0.21%, highlighting its stability amid volatile crypto trends. Its 24-hour trading volume is reported at $37.45 billion, a notable 42.71% decrease.

The Coincu research team highlights Tether’s role in facilitating regulatory actions and its potential impact on the cryptocurrency ecosystem. Freezing wallets tied to illicit activities might serve as a checkpoint for stablecoin issuers, pivoting towards greater accountability and regulation in global finance.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |