- Amid reports, no official sources validate Powell’s DOJ subpoena allegations.

- #Crypto markets require verification before impact analysis.

- Federal Reserve’s independence remains a key financial discussion.

Federal Reserve Chairman Jerome Powell has been rumored to face a grand jury subpoena over his Senate testimony, although no official sources confirm this event.

The alleged subpoena highlights potential political pressures on the Fed, with possible implications for financial markets, despite lacking verified official confirmation from the Department of Justice.

Potential Ripple Effects on Financial Markets

The purported event involved a DOJ grand jury subpoena targeting Jerome Powell’s testimony before the Senate Banking Committee last June. Powell emphasized that Federal Reserve policies should adhere to economic assessments rather than political directives. Despite these rumors circulating, there is no official confirmation from the DOJ or Federal Reserve to substantiate the claims.

The reported allegation posits that interest rate decisions may be influenced by factors other than economic conditions, raising concerns about Federal Reserve independence. In financial markets, such concerns could amplify volatility, although these changes remain speculative until further evidence is available.

Jerome H. Powell, Chair, Federal Reserve System – “There is no indication or verified evidence of any DOJ grand jury subpoena related to my June Senate testimony.” Federal Reserve Press Releases

Industry reactions emphasize the importance of Federal Reserve independence with major analysts and stakeholders highlighting the necessity of evidence-driven policy. Without verifiable sources, reactions remain primarily speculative, focusing on broader implications rather than immediate effects.

Current Crypto Market Status Amidst Speculative News

Did you know? The unverified claims about a DOJ subpoena highlight historical tensions, drawing parallels to past political pressures on the Federal Reserve, crucially impacting U.S. monetary policies.

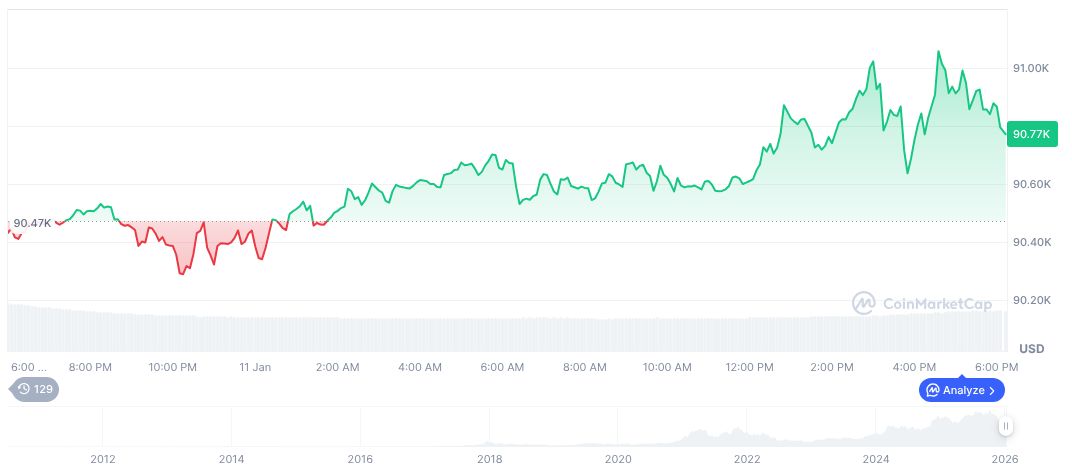

Bitcoin currently trades at $90,780.51, with a market cap of $1.81 trillion, dominating 58.45% of the crypto market. It has witnessed a 0.36% rise over 24 hours, yet declined 1.19% in the past week, per CoinMarketCap. Changes in Federal Reserve policies could affect its future value dynamics.

The Coincu research team suggests monitoring for any confirmed changes in Federal Reserve policy which could trigger broader financial or regulatory shifts. Historical patterns indicate that any perceived diminishment in policy independence may increase market volatility, impacting crypto valuation and security.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |