- Silver prices near record highs, impacting global markets.

- Silver traded at $83.9 per ounce in early 2026.

- No direct crypto linkage; macro conditions dominate.

Spot silver prices reached $83.9 per ounce on January 12, surpassing recent highs amid market fluctuations, reported PANews.

While hitting new highs, silver’s impact on crypto remains indirect, driven by broader macroeconomic conditions.

Silver Hits $83.9 and Nears Historical Highs

Spot silver’s reported rise to $83.9 per ounce marks a significant milestone in commodities trading, albeit not officially confirmed by primary pricing sources. Trading Economics listed silver at $81.33 USD per ounce on January 11, 2026, close to its all-time high of $83.62 in December 2025. Trading Economics

The pricing fluctuations reflect macroeconomic conditions, such as strong industrial demand and constrained supply chains, driving silver’s ongoing appeal as a hedge asset. Secondary impacts on digital assets remain broad and speculative, with no clear on‑chain activity directly linked to this movement.

Major industry figures have refrained from commenting directly on silver’s latest price actions. Investors watch closely for any broader market reactions or strategies as commodities continue to exhibit volatility. Central bank gold reserve additions further highlight the macroeconomic landscape’s influence on precious metals. World Gold Council

Trading Economics reports silver at 81.33 USD/t.oz on January 11, 2026, up 1.73% from the previous day and notes that silver’s all-time high is 83.62 in December 2025.

Silver’s Surge: Link to Bitcoin Remains Speculative

Did you know? Silver previously spiked over 30% post-Fed rate cuts in 2024, paralleling expectations in current market conditions.

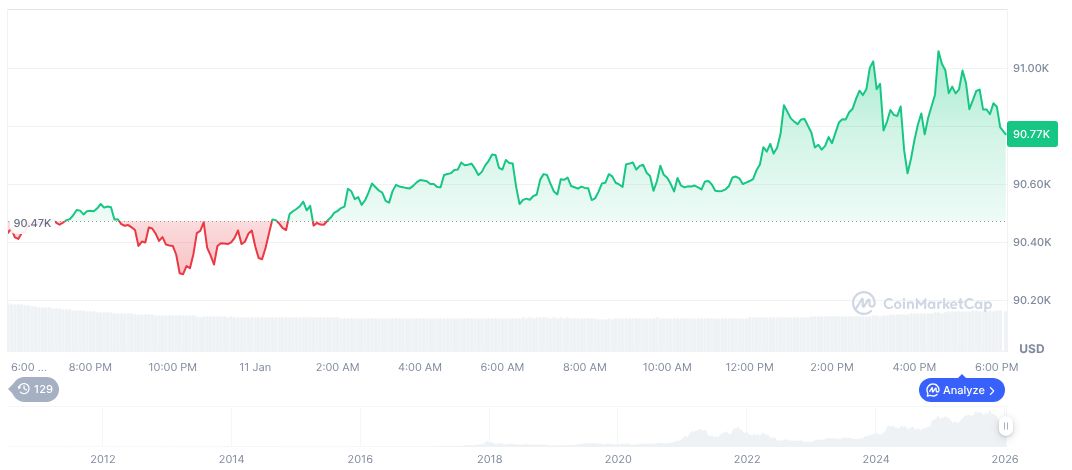

Bitcoin (BTC) is valued at $91,099.03, per CoinMarketCap’s latest data. Its market cap is $1.82 trillion with a 24-hour trading volume of $20.11 billion, representing a 65.48% increase from previous levels. Bitcoin’s 90-day performance shows a 20.51% decrease.

Coincu’s research team highlights that macroeconomic pressures influencing precious metals like silver could indirectly affect digital currencies such as Bitcoin, often regarded as “digital gold.” However, direct correlations remain speculative absent concrete causal data.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |