- U.S. President and financial leaders convene for Fed Chair talks.

- Implications for U.S. monetary policy and financial markets.

- Potential leadership change affects decision-making dynamics.

U.S. President Donald Trump is reportedly meeting with Rick Rieder of BlackRock this Thursday at the White House for a Federal Reserve Chairmanship interview.

The final interview for a critical leadership position may impact future economic strategy, but no confirmed market effects or cryptocurrency links have been noted so far.

Top-Level Talks on Fed Chair Succession

Reports suggest that the White House will serve as the venue for a meeting involving U.S. President Donald Trump, BlackRock’s Global Chief Investment Officer Rick Rieder, and other top officials. Speculation abounds as this meeting is allegedly part of choosing the next Federal Reserve Chairman. While Rieder has not confirmed the meeting, other candidates include former Federal Reserve Governor Kevin Wash and National Economic Council Director Hassett.

This seemingly clandestine meeting raises questions about policy shifts and its broader implications for the financial market, given Rieder’s renowned expertise. Despite concerns, no official confirmation from government portals or primary sources outlines the eligibility or likely outcomes tied to these discussions.

No statements from Rick Rieder on the White House meeting were found.

Crypto Volatility: Watch on Fed Chair Developments

Did you know? Despite formal denials, past Federal Reserve leadership shifts have historically influenced cryptocurrency volatility, often increasing BTC and ETH value fluctuations.

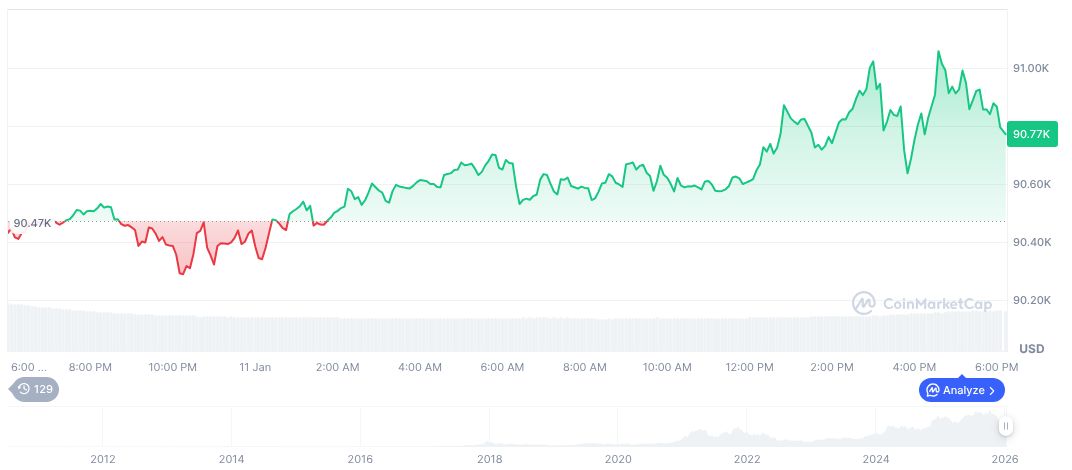

Bitcoin (BTC) holds substantial presence with a trading value of $90,630.70 and a market dominance of 58.53%. The current market cap stands at approximately $1.81 trillion, reporting a 24-hour trading volume of $31.61 billion with a 149.87% increase, according to CoinMarketCap. Despite a 17.92% decline over 90 days, the crypto giant continues its enduring influence.

Insights from Coincu research highlight the uncertainty surrounding potential changes in U.S. Federal Reserve leadership. This uncertainty fuels speculation on possible financial and regulatory shifts. Observers remain alert to potential adjustments in global market strategies that could influence crypto adoption rates and innovation trends, albeit in unconfirmed scenarios.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |