- Criminal investigation into Fed challenges market stability and independence.

- Market reacts with cautious sentiment, shifting to gold.

- Bitcoin impacted by broader market signals and whale activity.

On January 12th, concerns arose over the Federal Reserve’s independence under the Trump administration, impacting U.S. stock markets and prompting a shift to safe-haven assets like gold.

The threat to the Fed’s independence has repercussions for U.S. financial stability, influencing market performance and potentially affecting cryptocurrency sentiment near critical price levels.

Impact of Federal Reserve Probe on Global Markets

Federal Reserve Chair Jerome Powell addressed concerns regarding the Fed’s independence after a criminal investigation surfaced under the Trump administration. The probe raises concerns about potential influences on U.S. monetary policy and market reactions. Market volatility followed the investigation news, impacting stock index futures and trading sentiment across sectors.

Money shifted towards safe-haven assets such as gold, indicating increased investor caution. The investigation adds uncertainty to an already wary market environment. U.S. dollar declines coinciding with this concern show immediate investor hesitance in U.S. financial stability. Analysts predict short-term market underperformance unless clear resolution emerges.

J.P. Morgan’s Andrew Taylor commented that the threat to Federal Reserve independence creates a “suppressive factor” for market performance. In light of this situation, market experts are urging vigilance as continued scrutiny could affect broader markets. Direct claims confirm connections impacting stock futures and currency fluctuations.

Unprecedented Fed Scrutiny: Bitcoin and Gold Reactions

Did you know? The investigation into the Federal Reserve is unprecedented in recent history, revealing deep-seated concerns over monetary policy governance and market stability.

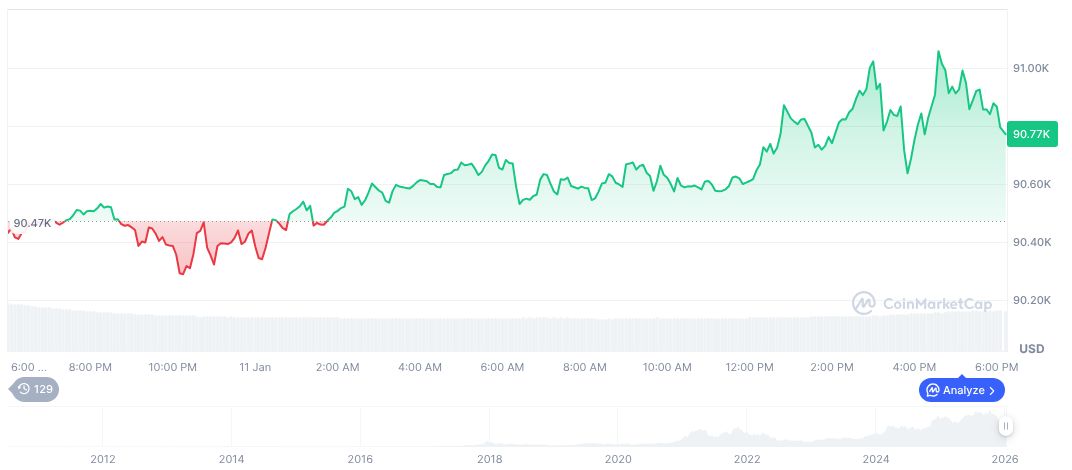

As of the latest data, Bitcoin (BTC) is priced at $90,679.17, holding a market cap of 1.81 trillion and commanding 58.54% of market dominance. Noted is a recent price downturn—down 0.19% over 24 hours, with further declines noted over the past 90 days. (Source: CoinMarketCap)

Coincu Research projects the ongoing scrutiny of Fed policies could accelerate shifts towards gold and alternative stores of value. This upheaval may drive increased scrutiny in cryptocurrency regulations, reflected in expert insights suggesting investors re-evaluate holdings in light of evolving guidelines and market adaptations.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |