- Visa partners with BVNK to enable stablecoin payments using Visa Direct.

- Reduces payment friction during weekends and holidays.

- Accelerates global stablecoin technology adoption.

Visa and BVNK announced a partnership to integrate stablecoin functionality into Visa Direct, enabling businesses to use stablecoins for pre-funded payments in specific markets.

This partnership aims to enhance global payment systems by reducing friction and offering faster, efficient transactions, particularly during non-banking hours, opening new pathways in the payments infrastructure.

Visa Direct Enhances Payment with Stablecoins

Visa and BVNK have announced a collaboration to incorporate stablecoin functionality into the Visa Direct platform. This partnership enables businesses to make pre-funded payments using stablecoins in select markets, sending funds directly to recipients’ digital wallets. The initiative is described by Mark Nelsen, Visa’s Global Head of Product, as a step towards greater adoption of stablecoin technology, enhancing global payment efficiency and access, particularly outside traditional banking hours.

The integration of stablecoins via Visa Direct represents a shift towards digital asset-based payments, promising reduced transactional friction and enhanced access. BVNK CEO, Jesse Hemson-Struthers, emphasized this collaboration as an opportunity to redefine payment systems, underscoring the transformational potential of stablecoins in global finance.

“At Visa, we have a long history of embracing new technologies that modernize money movement. Stablecoins are an exciting opportunity for global payments, with enormous potential to reduce friction and expand access to faster, more efficient payment options – including during weekends, holidays and when banks are closed. BVNK shares this vision, and that’s why we’re partnering with them to provide the reliable, trusted and necessary infrastructure needed to expand our Visa Direct stablecoin pilots.”

Stablecoin Market Insights and Regulatory Expectations

Did you know? Visa has been at the forefront of digital payment innovations, continuously adapting to new technologies that enhance the efficiency of money movement.

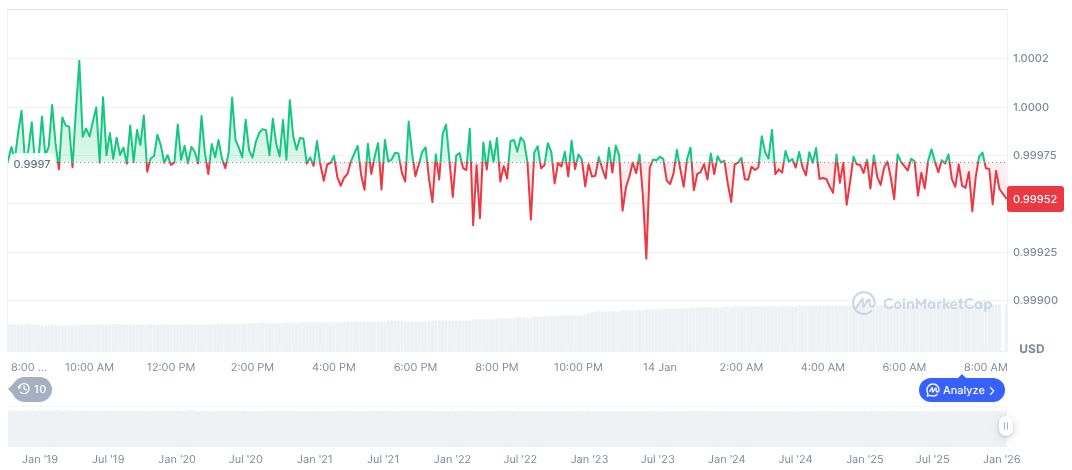

According to CoinMarketCap, USDC is currently priced at $1.00, reflecting a stable financial trajectory. Its market cap stands at $75.06 billion, while the 24-hour trading volume has experienced a 69.33% change, totaling $20.26 billion. USDC’s price has seen minor adjustments over various timelines, demonstrating slight resilience in fluctuating market conditions.

The Coincu research team anticipates that Visa’s integration of stablecoins with BVNK could prompt broader financial adoption of digital currencies. Regulatory aspects might evolve, as stablecoins increasingly become integral to mainstream payment networks, potentially influencing technological advancements in global finance.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |