- Hong Kong plans to enhance stablecoin regulation and expand gold storage capacity.

- Stable cryptocurrencies aim for greater stability.

- Gold storage to grow to 2,000 tons by 2026.

Hong Kong’s Deputy Financial Secretary, Huang Weilun, announced plans to advance stablecoin developments and gold storage capacity during a recent event.

This move aims to stabilize the financial system and expand market opportunities, potentially impacting fiat-referenced stablecoins and gold trade operations.

Stablecoin Regulation Expected to Increase by 2026

Immediate changes involve stringent regulation for stablecoins as Hong Kong gears up its financial infrastructure. Stablecoins and tokenized assets may face a 1250% risk weighting from January 2026. This action reflects the government’s meticulous strategy to bolster the financial framework’s resilience and adapt to digital asset innovations.

The finalized bank Basel crypto rules effective January 1, 2026 impose a 1250% risk weight for stablecoins on permissionless chains.

The crypto community has yet to fully react to these announcements. However, the emphasis on stability suggests a cautious but definitive stride toward integrating stablecoins into regulated financial ecosystems. While some anticipate slower growth due to higher regulatory scrutiny, others see potential in Hong Kong’s strategic positioning.

Market Data and Insights

Did you know? Hong Kong’s regulatory approach could significantly shape the global trajectory of stablecoin adoption, marking a shift in digital finance dynamics from unregulated growth to controlled expansion.

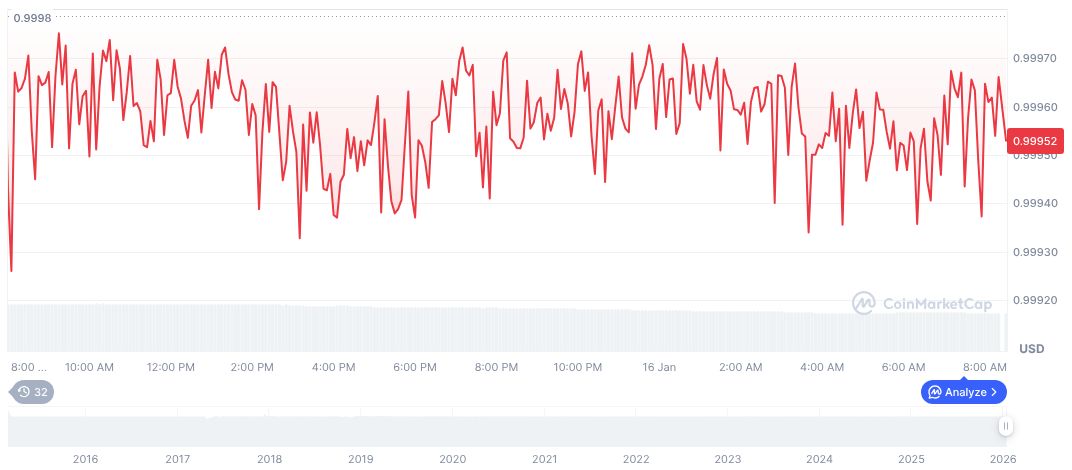

Tether USDt (USDT) maintains its standard $1.00 price with a market cap of 186,773,602,108, reflecting a 5.77% market dominance per CoinMarketCap. Despite a 24-hour trading volume drop by 18.02% to 99,518,542,887, price stability remains with a 0.00% daily change.

In light of historical trends, Coincu research anticipates a bolstered financial infrastructure in Hong Kong could spur advancements in digital asset regulation. Enhanced regulation may influence investor confidence positively, although stringent measures might initially temper market exuberance.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |