In Brief

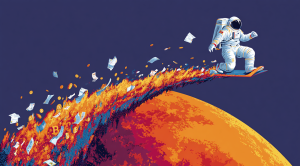

- Sharp drop in Stablecoin Supply Ratio signals Bitcoin’s undervaluation.

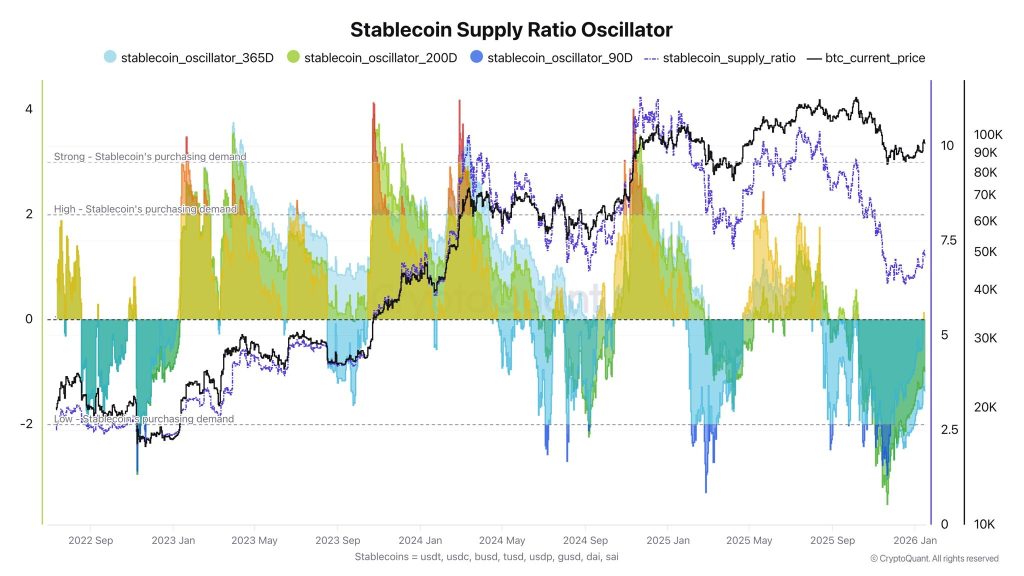

- Bitcoin’s Open Interest falls, indicating risk reduction and potential for recovery.

- Reclaiming $93,500 key for Bitcoin’s breakout and future momentum.

Bitcoin’s recent market correction has provided a strong signal for potential future gains. The collapse in Bitcoin’s price has created an imbalance in the market, indicating that the cryptocurrency is currently undervalued.

The Stablecoin Supply Ratio (SSR) has seen a sharp decline, signalling a major imbalance between Bitcoin’s market cap and the available liquidity in stablecoins. This ratio compares Bitcoin’s total market cap to the market cap of stablecoins, offering insight into liquidity dynamics.

As the price of Bitcoin drops, stablecoins have largely remained unchanged, indicating that buying power is ready to re-enter the market.

When the SSR falls sharply, it indicates that Bitcoin is undervalued compared to the amount of liquidity available. Historically, such a situation has often marked the formation of a market bottom. As stablecoins remain on the sidelines, investors may soon deploy this liquidity, pushing Bitcoin prices higher once it’s activated.

Futures Markets and Open Interest Provide Key Insights

Bitcoin’s futures market has experienced significant changes following the recent price correction. Open Interest (OI) fell by nearly 17.5%, dropping from 381,000 BTC to 314,000 BTC. This reflects a phase of risk reduction and unwinding of leveraged positions, with Binance holding 36% of the total OI.

The recent decline in Open Interest suggests that the market was adjusting its exposure amid Bitcoin’s correction. However, this drop in OI could indicate that risk appetite is returning slowly, which might signal a return to bullish momentum. If this trend continues, the return of exposure could support further upward movement in Bitcoin’s price.

Bitcoin’s current chart shows that it has rejected from key Bull Market EMAs and needs to reclaim the $93,500 level. This rejection and the retest of $93,500 resemble the structure seen in April 2025, when Bitcoin successfully broke out.

Monitoring the recovery of the $93,500 level throughout this week will be key to confirming whether Bitcoin can sustain its bullish momentum.

The combination of these market indicators suggests that Bitcoin is poised for a potential rebound as liquidity from stablecoins enters the market, supporting future price gains.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |