- Iran’s Central Bank receives $500 million USDT to bolster the rial.

- Elliptic research links transactions to Modex; funds have exited Iran.

- No official confirmations; outlines cryptocurrency’s role in Iranian sanctions circumvention.

The Central Bank of Iran reportedly acquired over $500 million in USDT in 2025, potentially to maintain the rial’s stability, according to blockchain intelligence firm Elliptic.

This maneuver highlights potential impacts on Iran’s economy and draws attention to the interplay between cryptocurrency and geopolitical financial strategies.

Iran Allegedly Uses USDT to Prop Up Rial

Elliptic’s research revealed that the Iranian central bank had allegedly acquired over $500 million USDT last year, with all the funds now exited through wallets. The transactions appear to involve a cryptocurrency broker named Modex, possibly aligning with the Iranian government’s efforts to support the economy.

The removal of these funds suggests a covert strategy to enhance the value of the Iranian rial, reflecting broader financial maneuvers in the face of economic sanctions. Such undisclosed financial channels raise questions about regulatory oversight and the resilience of cryptocurrency networks in managing global sanctions.

Mohammad Bagher Ghalibaf, Iranian Parliament Speaker, said, “Cryptocurrencies provide new ways to do business and pay for trade. We want Iran to become a regional, and even global hub in blockchain technology and digital trade.” source

Regulatory Scrutiny and Cryptocurrency Stability Amid Sanctions

Did you know? Iran’s engagement with cryptocurrency is linked to its strategy of circumventing international sanctions, reflecting an ongoing trend since the early 2020s where digital assets play a crucial role in geopolitical economic maneuverings.

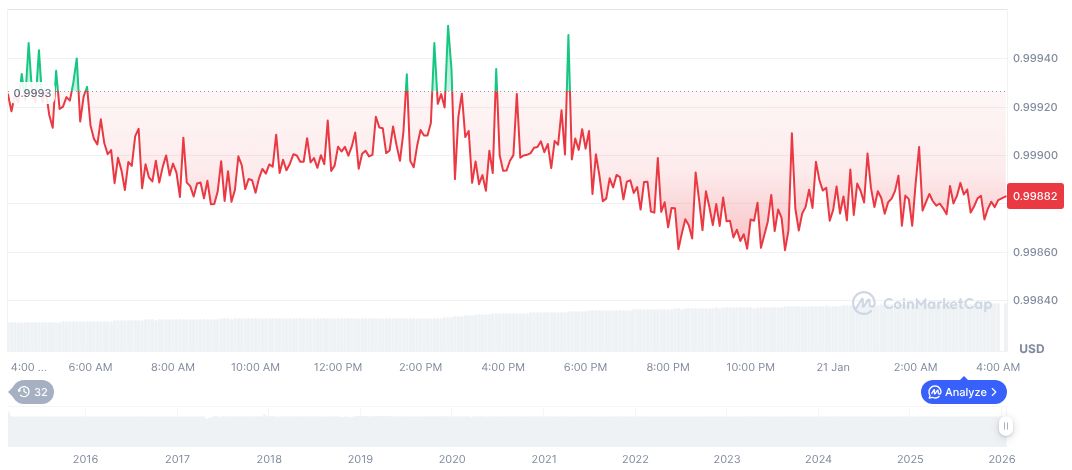

According to CoinMarketCap, Tether USDt (USDT) maintains a steady value of $1.00, with a market cap of $186.91 billion and a daily trading volume of $111.85 billion, reflecting a 2.79% increase over the last 24 hours. Despite controversies, it exhibits stability amid digital financial landscapes.

The Coincu research team suggests potential outcomes could include increased scrutiny on stablecoins in international finance and sanctions. Historically, such transactions invite regulatory challenges, heightening tensions between digital and traditional financial systems globally.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |