Key Insights:

- Ethereum faces a $3,000 support challenge, $3,200 target possible with a successful rebound.

- $287M Ethereum ETF outflows signal institutional caution, yet DeFi ecosystem remains strong.

- The stablecoin market capitalization of $161.6B indicates ongoing liquidity and trading activity.

Ethereum’s price is currently testing its $3,000 support level, with traders watching closely to see if it can hold above this mark. The cryptocurrency is navigating a challenging period as it tries to reclaim a higher range.

Ethereum’s Recent Price Movement

Ethereum’s price has recently been fluctuating around $2,959.54, showing a minor drop of 0.45% in the past 24 hours. Despite this, ETH has experienced notable volatility over the last few days. According to Tedpillows, a successful rebound above $3,000-$3,050 could push ETH towards the $3,200 target.

This statement suggests that if Ethereum can break through this resistance range, it may return to a stronger upward trend. The challenge for Ethereum, however, is the difficulty in maintaining the $3,000 support.

Failure to maintain this level, Ethereum further declines could be expected, potentially reaching new lows for the year. As of now, the price remains near the critical $3,000 level, and traders are cautious about potential losses.

Large Ethereum ETF Outflows and Market Activity

However, the Ethereum market sentiment is also affected by large outflows from Ethereum-based ETFs. A reported outflow of $287 million from Ethereum ETFs, including a $250 million sale by BlackRock, has added to the downward pressure. This move reflects a cautious approach by institutional investors, which may signal concerns about the short-term price direction of Ethereum.

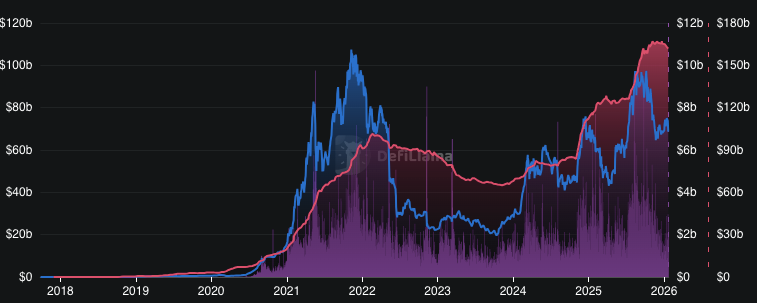

Despite these outflows, Ethereum’s decentralized finance (DeFi) ecosystem remains resilient. The total value locked (TVL) in DeFi applications holds steady at $69.6 billion, with a slight 1.34% daily increase. DEX (decentralized exchange) trading volume has also remained active, reaching $2.56 billion over the past 24 hours. This suggests continued interest and liquidity in Ethereum-based platforms, even with the recent price struggles.

While Ethereum’s price has been under pressure, the stablecoin market continues to show strength. The total market capitalization for stablecoins stands at $161.6 billion, indicating a solid level of liquidity in the crypto ecosystem. The stability in stablecoin values highlights ongoing user engagement and trading activity, particularly on decentralized platforms.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |