XRP Price Forecast 2026: ETF Flows, Technical Triggers, and a Scenario Matrix

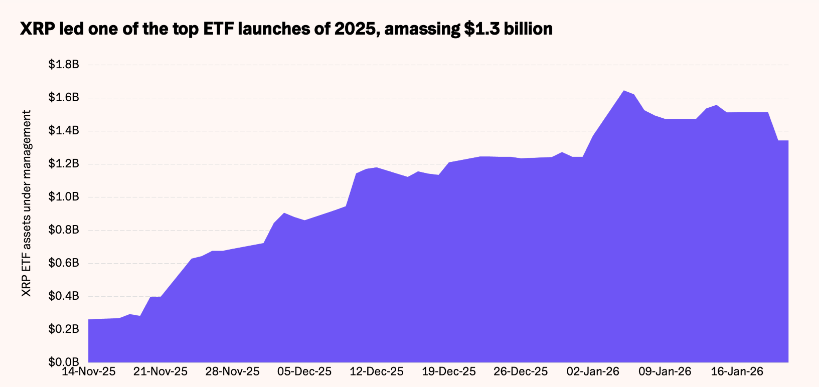

XRP Price Forecast 2026 is now driven by institutional capital rather than retail speculation. With spot XRP ETFs surpassing $1.24 billion in cumulative inflows and regulatory clarity improving, XRP is transitioning into a structurally supported market.

XRP is compressing inside a $2.00–$3.66 consolidation range, with breakout triggers at $2.60 and $3.00. Legal progress, ETF momentum, and RLUSD-driven ecosystem expansion are now aligning. This article maps ETF flows, technical triggers, and macro catalysts into a single scenario framework.

XRP trend, momentum, and key levels this week

XRP tends to track Bitcoin when global liquidity tightens and risk-off capital rotates back into BTC dominance. This correlation strengthens when bond yields rise and institutional investors reduce exposure to high-beta assets.

Under these conditions, altcoins including XRP lose relative momentum regardless of their internal fundamentals, shaping the short-term XRP Price Forecast.

XRP is trading near $1.87–$1.93, after failing to hold its post-ETF breakout gains. The broader market is still digesting the impact of new institutional access while macro conditions remain restrictive. XRP’s inability to extend higher despite bullish news shows that liquidity, not narratives, is the dominant short-term driver for the XRP Price Forecast.

This policy shift ended Japan’s yield curve control, triggered historic volatility in Japanese government bonds, and removed a major source of global cheap liquidity, reinforcing a risk-off macro environment.

Structural support factors

- ETF inflows: U.S. spot XRP ETFs attracted $90M+ this month, absorbing sell pressure.

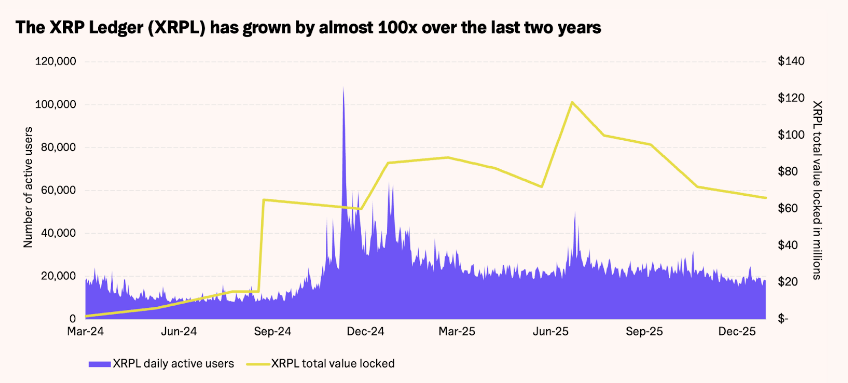

- On-chain growth: XRPL processes >2M daily transactions, a level historically associated with bullish expansions.

- Legal clarity: Ninth Circuit dismissed a class action against Ripple Labs on Jan 27, 2026.

Breakout/breakdown map: support, resistance, and triggers

XRP is compressing between long-term support and institutional supply zones, forming a volatility coil. This structure typically resolves in a directional breakout once macro liquidity or ETF flows shift meaningfully. The current range therefore acts as both a springboard and a trap.

From TradingView charts, XRP is holding a base near $1.50 with overhead resistance zones at $2.50 and $3.50. The chart projection maps a potential path toward a $5 target if momentum re-enters the market.

- Primary support: $1.50

- Mid resistance: $2.50

- Upper resistance: $3.50

- Macro target path: $5

This breakout map which identifies the $2–$3 range as the base scenario for the 2026 XRP Price Forecast, with expansion only occurring if ETF capital flows and exchange supply compression intensify.

RSI, MACD, 50-day and 200-day moving averages, Fibonacci

Trend control only changes when XRP decisively reclaims or loses its long-term moving averages. These levels function as objective invalidation points for both bullish and bearish theses. Price behavior around these averages defines whether accumulation is genuine or merely corrective in the XRP Price Forecast.

- MA50: $1.98

- MA200: $2.55

A sustained close above the 50-day MA signals weakening bearish pressure, while reclaiming the 200-day MA confirms a structural trend reversal. Conversely, repeated rejection below these levels indicates that distribution is still dominating price action in the XRP Price Forecast.

Bitcoin correlation: when XRP tracks or decouples from BTC

Bitcoin Dominance (BTC.D) shifts, ETF flows, yields, Japan risk-off liquidity

XRP only decouples from Bitcoin when its internal capital flows and utility growth overpower global liquidity conditions. When bond yields rise and central banks tighten, XRP historically reverts to tracking Bitcoin’s direction. This dynamic explains why the XRP Price Forecast underperforms in risk-off phases but accelerates sharply once liquidity returns.

- BTC price: $88,148

- BTC dominance: 59.55%

- U.S. 10Y yield: 4.26%

- BoJ policy rate: 0.75% (highest since 1995)

Rising U.S. yields and Japan’s exit from yield curve control ended the era of ultra-cheap liquidity. This created a global risk-off environment that typically pushes capital back into Bitcoin, suppressing altcoin beta. As long as BTC.D remains elevated and macro volatility persists, XRP’s upside is constrained despite its strong fundamentals.

Altcoin rotation: XRP vs Bitcoin (BTC) when XRP Ledger (XRPL) leads

XRP historically outperforms Bitcoin during late-cycle rotation phases, when investors shift from store-of-value narratives toward high-utility settlement assets. This rotation usually begins once Bitcoin dominance peaks and marginal capital seeks higher beta exposure. The current performance divergence already reflects the early stage of this transition.

| Metric | BTC | XRP |

|---|---|---|

| YTD 2026 | +5.5% | +24% |

| Utility | Store of value | Cross-border payments, asset bridge |

When XRPL network usage, ETF inflows, and stablecoin settlement volumes expand simultaneously, XRP becomes a liquidity magnet rather than a passive altcoin. In those phases, XRP does not follow Bitcoin; instead, it establishes its own trend driven by enterprise adoption and transaction demand.

Near term vs 2026 bear/base/bull paths with invalidation

2026 fundamentals: Ripple Labs, ODL, RippleNet, U.S. SEC

XRP’s long-term valuation is increasingly linked to real transactional utility rather than speculative narratives. Regulatory clarity and enterprise-grade infrastructure have repositioned XRPL as a settlement and tokenization layer, strengthening the long-term XRP Price Forecast.

- Spot XRP ETFs: $1.3B AUM in the first month.

- RLUSD growth: ~1,800% market cap expansion.

- RippleNet volume: >$15B/month cross-border.

- ODL usage: ~40% of partners use XRP, cutting pre-funding by up to 65% and costs 40–60%.

Ripple’s expansion into treasury management, tokenized assets, and real-time settlement bridges traditional finance with blockchain rails. As usage scales, XRP transitions from a speculative asset into a transactional liquidity instrument, reinforcing its role within institutional payment infrastructure.

50-day Moving Average, 200-day MA on TradingView, CoinMarketCap

Trend control only changes when XRP decisively reclaims or loses its long-term moving averages. These levels function as objective invalidation points for both bullish and bearish theses. Price behavior around these averages defines whether accumulation is genuine or merely corrective in the XRP Price Forecast.

Quick Fact: BingX exchange is offering exclusive perks for new users and VIP traders.

For XRP, the 50-day MA is $1.98, while the 200-day MA is $2.55. As long as price remains below both levels, the broader structure is considered bearish. A sustained break above the 50-day MA signals early trend reversal, while reclaiming the 200-day MA confirms a long-term bullish regime for the XRP Price Forecast.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |